chernikasite.ru

Tools

I Just Want To Isolate Myself

isolate. Things You Should Know. If your friend is going through a rough You might just want to spend some time just being in each other's presence. “I feel like nobody needs me.” “I feel like I don't really exist.” “I feel alone within myself.” “It feels safer to be alone. But, like everything in excess, withdrawing myself turns toxic, and isolation is one of the most toxic habits we can fall into. Although I. In the case of mood-related isolation, the individual may isolate during a depressive episode only to 'surface' when their mood improves. Last edited just now. I am 30, unmarried. I had some good friends but lately I don't feel like talking to them. I just want to stay home and don't want to interact with anyone. burdens by myself,” or “if I disappear tomorrow, no one will even notice.” It was a lightbulb moment for me: social disconnection was far more common than I. Use these 10 steps to transform your life in the next month. Self-isolate Want chernikasite.ru ✧ self-help books that changed my. #druski #culturehustler · Self Isolation Quotes · Isolate Myself from Everyone · Isolating Myself · Lock in Quotes · Why Do I Isolate Myself. Yes, this is hard to do when you want to isolate yourself from the world. However, if you trust one person, let that person get you moving again! Don't let. isolate. Things You Should Know. If your friend is going through a rough You might just want to spend some time just being in each other's presence. “I feel like nobody needs me.” “I feel like I don't really exist.” “I feel alone within myself.” “It feels safer to be alone. But, like everything in excess, withdrawing myself turns toxic, and isolation is one of the most toxic habits we can fall into. Although I. In the case of mood-related isolation, the individual may isolate during a depressive episode only to 'surface' when their mood improves. Last edited just now. I am 30, unmarried. I had some good friends but lately I don't feel like talking to them. I just want to stay home and don't want to interact with anyone. burdens by myself,” or “if I disappear tomorrow, no one will even notice.” It was a lightbulb moment for me: social disconnection was far more common than I. Use these 10 steps to transform your life in the next month. Self-isolate Want chernikasite.ru ✧ self-help books that changed my. #druski #culturehustler · Self Isolation Quotes · Isolate Myself from Everyone · Isolating Myself · Lock in Quotes · Why Do I Isolate Myself. Yes, this is hard to do when you want to isolate yourself from the world. However, if you trust one person, let that person get you moving again! Don't let.

Use their own personal items (like cups, towels and toothpaste) and not share these with others. Eat apart from the rest of the family. Wear a mask if they. just watch first if you're feeling nervous. consider visiting places where you can just be around other people – for example, a park, the cinema or a cafe. Like many who relish solitude, I've always championed quality over quantity when it comes to relationships. For myself and fellow isolators, a handful of. I'm just so hurt from everything that happened to me that I want to isolate myself. I might give up. I'm really hurt and angry. I just don't want this anymore. I like to think of total isolation as a way of starting from scratch. In life, sometimes we gather unhealthy people and experiences around us. A desire to distance oneself from everyone— also known as a desire to isolate oneself— is a common symptom of major depression. Negative thought. My anxiety and depression isolates me from people and stops me from being able to do the things I'd like to do. So socially it cuts me off. What causes. For some, it's the result of a traumatic experience or a mental health condition like social anxiety or PTSD. Others might be coping with the loss of a loved. Is this what I really want? What else is out there?” These few weeks of empty schedule have given me space and time to reflect on the hustle. I want to live and not isolate myself. 7 response(s). Julie U. It has. I've I really like doing the daily coaching and then writing an entry on there. I just want to isolate myself from everyone. PM · Jun 10, ·. Views. 1. Like. It's not something I plan; it just happens. I stop answering calls, ignore texts, and avoid being around people. It's not that I don't want. I isolate myself in my room from my husband and kids bc I don't wanna be asked what's wrong all the time, or why are you angry? If I stay in my room No one. This only makes me want to isolate myself even more! Log in to Reply. Kenna But I never like such things, I just tried involve myself. At present I. We do not want others to see our shame. The questions we have about whether we are truly valued by our partner (who just ourselves. In the face of the. Current mood: I just want to isolate myself from everyone. PM · Aug 20, ·. 2, Views. Likes. 1. Bookmark. 1. Most relevant. like you've done something wrong. We all have our own individual needs and concerns, and watching someone we love self-isolate is really difficult. 37 Likes, TikTok video from Barbara☝️☝️☝️ (@bubbles_capricorn): “I just want to isolate myself for days lol #imtiredofthisgrandpa #fyp. There are days where I feel like I'm drowning in sadness, and I don't want to speak to anyone about it. Sometimes, I just isolate myself in my room and. No good libertarian I know wants us to completely isolate ourselves from the rest of the world. It's not even possible. I mean there are economic ties - there.

Webull Is It Good

Webull is a commission-free online brokerage and stock trading app for novice and experienced investors. Generally speaking, Robinhood and WeBull reviews suggest that WeBull has a wider selection of research and analysis tools that are important to expert traders. Webull is a great deal for the trader or active investor who doesn't need hand-holding. There is no minimum account size, the margin rates are competitive, and. Bottom line: Webull vs. Robinhood Webull could be a better choice than Robinhood for investors who want more market data and charting capabilities out of the. Webull is one of the best option in my opinion. It's simple to use, no fees, works well, easy for anyone even for newbies. Trading Platforms. Webull gives users a few ways to view and access their accounts. The Webull desktop trading platform and web version are nearly identical. Join the people who've already reviewed Webull. Your experience can help others make better choices. Webull is an online discount broker, best suited to stock and ETF traders who rely on technical analysis, offering great charting tools and advanced trading. Webull has really good charting tools and research and studies/news. Webull also has good customer service where Robinhood's sucks. Webull is a commission-free online brokerage and stock trading app for novice and experienced investors. Generally speaking, Robinhood and WeBull reviews suggest that WeBull has a wider selection of research and analysis tools that are important to expert traders. Webull is a great deal for the trader or active investor who doesn't need hand-holding. There is no minimum account size, the margin rates are competitive, and. Bottom line: Webull vs. Robinhood Webull could be a better choice than Robinhood for investors who want more market data and charting capabilities out of the. Webull is one of the best option in my opinion. It's simple to use, no fees, works well, easy for anyone even for newbies. Trading Platforms. Webull gives users a few ways to view and access their accounts. The Webull desktop trading platform and web version are nearly identical. Join the people who've already reviewed Webull. Your experience can help others make better choices. Webull is an online discount broker, best suited to stock and ETF traders who rely on technical analysis, offering great charting tools and advanced trading. Webull has really good charting tools and research and studies/news. Webull also has good customer service where Robinhood's sucks.

Webull is a stock brokerage firm offering zero commission stock trades on both mobile and desktop. They're currently the biggest threat to Robinhood. As the title indicates, I really like WeBull because it allows access to the market the earliest of any trading applications out there (AM EDT). I always. Many use Webull for day trading and short-term trading strategies. The platform is great for these investors as they enjoy zero commission fees, good margin. Margin is not available in all account types. Margin trading privileges are subject to Webull Financial, LLC review and approval. Leverage carries a high level. Webull is a great investing platform, especially if you're an active trader who want lots of options, low costs, advanced trading tools and the ability to save. Webull is a solid broker choice for investors who are looking for a low-cost mobile trading platform. While not as well known as rival Robinhood. Webull is a new commission-free stock trading app that makes it easy (and affordable) to buy and sell stocks online. Webull Financial LLC is a member of SIPC, which protects securities customers of its members up to $, (including $, in any cash awaiting. Read honest reviews & opinions about Webull by verified clients. Comprehensive feedback to help you make informed decisions. Webull is a legitimate and legal brokerage, with oversight from FINRA and SEC. Customers' accounts are protected by the Securities Investor Protection. Webull offers all the investing products you need - stocks, ETFs, options, futures, and more—no matter your experience level. Earn % on your uninvested. Bottom Line. Webull is a good option for the undercapitalized active trader who only want to day trade stocks and options. It could also be an excellent choice. Right At Your Fingertips Trade stocks, ETFs and options for Zero Commission* with no account minimum. Get up to 12 free fractional stocks when you open and. Webull is a discount broker that allows commission-free trading of stocks, ETFs, options, and crypto. It supports both taxable and IRA retirement accounts. Webull is a discount broker that allows commission-free trading of stocks, ETFs, options, and crypto. It supports both taxable and IRA retirement accounts. Webull offers a modern trading and investing platform with low costs, advanced trading tools and a robo-advisor. Webull is a no-fee stock trading app with many great investing tools. Learn the details and see how it stacks up to Robinhood in this review. Webull Financial has an overall rating of out of 5, based on over 43 reviews left anonymously by employees. 76% of employees would recommend working at. Free trading of stocks, ETFs, and options refers to $0 commissions for Webull Financial LLC individual cash or margin accounts. Index Option Contract Fees. Regarding safety, WeBull is considered a safe program because top-tier financial authorities regulate it. They provide a maximum of $, in investor.

Best Pet Vacuum And Carpet Cleaner

Pet Vacuums(+) · BISSELL PowerForce Helix Bagless Upright Vacuum · Prettycare Cordless Stick Vacuum Cleaner Lightweight for Carpet Floor Pet Hair W Even our carpet cleaning solution is an EPA Safer Choice product, which means it is safe for you, your pets and, the environment. In other words, a carpet. The Shark EX CarpetXpert led the pack, closely followed by the Kenmore KW RevitaLite Pet and Bissell Big Green Professional. BISSEL's best deep-cleaning system for pets. Tackle dirty carpets and pet messes with this Pet Pro Cleanup System. The cleanshot pre-treater blasts away spots. Are cordless vacuums good for carpet? Shop Chewy for the best dog vacuums and steam cleaners. Say goodbye to unsightly pet messes and hello to a pristine home. Best Overall: Dyson Ball Animal 2 Upright Vacuum. · Best Robot: iRobot Roomba e5 () Wi-Fi Robot Vacuum Cleaner. · Best for Hardwood. You know that BISSELL® carpet cleaners use a combination of cleaning solution, powerful scrubbing brushes and vacuum suction to remove set-in pet stains – like. Top Seller · Pet Hair Eraser® Turbo Rewind Vacuum Cleaner · MultiClean™ Allergen Pet Rewind Upright Vacuum · CleanView® Bagged Pet Upright Vacuum Cleaner. Pet Vacuums(+) · BISSELL PowerForce Helix Bagless Upright Vacuum · Prettycare Cordless Stick Vacuum Cleaner Lightweight for Carpet Floor Pet Hair W Even our carpet cleaning solution is an EPA Safer Choice product, which means it is safe for you, your pets and, the environment. In other words, a carpet. The Shark EX CarpetXpert led the pack, closely followed by the Kenmore KW RevitaLite Pet and Bissell Big Green Professional. BISSEL's best deep-cleaning system for pets. Tackle dirty carpets and pet messes with this Pet Pro Cleanup System. The cleanshot pre-treater blasts away spots. Are cordless vacuums good for carpet? Shop Chewy for the best dog vacuums and steam cleaners. Say goodbye to unsightly pet messes and hello to a pristine home. Best Overall: Dyson Ball Animal 2 Upright Vacuum. · Best Robot: iRobot Roomba e5 () Wi-Fi Robot Vacuum Cleaner. · Best for Hardwood. You know that BISSELL® carpet cleaners use a combination of cleaning solution, powerful scrubbing brushes and vacuum suction to remove set-in pet stains – like. Top Seller · Pet Hair Eraser® Turbo Rewind Vacuum Cleaner · MultiClean™ Allergen Pet Rewind Upright Vacuum · CleanView® Bagged Pet Upright Vacuum Cleaner.

Made for Pet Hair Carpet & Steam Cleaning · BISSELL TurboClean PowerBrush Pet Made For Pet Hair Carpet Cleaner with Rotating Brush · BISSELL Little Green ProHeat. Shop the top names in carpet care and find the carpet cleaner, washer, or extractor to deep clean your carpets and rugs, eliminate stains and odors. Best Canister Vacuum: Miele Bagged Canister Vacuum · Best Portable Upright Vacuum: Eureka Bagless Upright Vacuum Cleaner · Best Stick Vacuum: Greenote Cordless. Best Canister Vacuum: Miele Bagged Canister Vacuum · Best Portable Upright Vacuum: Eureka Bagless Upright Vacuum Cleaner · Best Stick Vacuum: Greenote Cordless. Our picks—the Tineco Carpet One Smart Carpet Cleaner and the Bissell ProHeat 2X Revolution Pet Carpet Cleaner—cleaned up most of the stains they were. A carpet cleaner with deep cleaning Our carpet cleaning equipment is powerful enough to remove stubborn dirt, stains and pet hair and our steam cleaners will. Carpet. NEY Portable Carpet Cleaner. Learn More. Trusted by Our Customers "Great for pet fur! Very versatile, quite an innovation!" — Toshia. Featuring Dyson's most advanced filtration in a cordless vacuum, the Dyson V15 Detect vacuum has a HEPA post-motor filter that traps particles as small as Carpet Cleaners · Best Seller · Shark® Stainstriker™ Portable Carpet & Upholstery Cleaner, Spot & Stain Remover, 3 · BISSELL Little Green Max Pet Carpet Cleaner . Tineco iFloor 3 Ultra Cordless Wet Dry Hard Floor Vacuum · Cut Cleaning Time in Half – Mop & Vacuum in One Easy Step ; BISSELL ProHeat 2X Revolution Pet Pro. The Oxy Pet Urine and Stain Eliminator is Hoover's best formula to permanently eliminate pet stains and odor from urine. This enzymatic formula powerfully. Shark® CarpetXpert™ with Stainstriker™, 2-in-1 deep carpet cleaner and built-in spot & stain cleaner delivers the best tough stain elimination** and. Shark CarpetXpert with Stainstriker, 2-in-1 deep carpet cleaner and · EX · ; BISSELL Little Green Max Pet Portable Carpet & Upholstery Deep Cleaner. Vacuum Cleaners For Pet Owners · Our top-selling pet vacuums · Hoover Upright Pet Vacuum Cleaner with Anti Hair Wrap Blue - HL4 · Hoover Cordless Vacuum Cleaner. Patented double triangular mops; Automatic carpet detection; Worry-free cleaning; Adaptation of various soil types; Cleaning the edges Shark UltraLight Pet. Best in class with the Most Suction Power* removing the toughest stains and odors for the deepest clean · Handheld Dual-Action Pet Tool with rubberized bristles. Discover rechargeable cordless stick vacuums & robot vacuums from Samsung. For the perfect clean on hardwood floors, carpet, pet hair, & more. From tackling pet hair to cleaning your whole home, Dyson has a cordless vacuum for every need. Take our quick vacuum finder test or compare ranges to find. 47 videosLast updated on Jul 15, Carpet Cleaner Reviews at Vacuum Wars. Play all · Shuffle · [Private video] · · Best BUDGET Vacuums of Carpet Cleaning ; Shark® StainStriker™ Portable Carpet & Upholstery Cleaner - Spot, Stain, & Odor Eliminator. () ; BISSELL SpotClean Portable Carpet Cleaner.

Best Performing Small Cap Value Etf

AVUV is multi-factor efficient, with screening rules that not only give you excellent concentration in small and value factors, but also higher. It invests in value stocks of small-cap companies. The fund seeks to benchmark the performance of its portfolio against the Russell Value Index. American. The 5 Top Performing Small Cap Value ETFs of ; FYT · First Trust Small Cap Value AlphaDEX Fund, % ; AVUV · Avantis U.S. Small Cap Value ETF, % ; RZV. Best Performing in Small Value Over the Last Year · ETF Details · Vanguard Small-Cap Value ETF Overview · About Vanguard Small-Cap Value ETF (VBR) · Assets Under. Prior to listing on June 14, , the following ETFs operated as mutual funds: US Equity ETF, US Core Equity 2 ETF, US Small Cap ETF, and US Targeted Value. The iShares S&P Small-Cap Value ETF seeks to track the investment results of an index composed of small-capitalization US equities that exhibit value. Hamilton Canadian Bank Mean Reversion Index ETF and RBC Canadian Bank Yield Index ETF were among the worst-performing ETFs in Q2 ETF Illustration. JPMorgan Active Small Cap Value ETF · THIS FUND IS DIFFERENT FROM TRADITIONAL ETFsTraditional exchange-traded funds (ETFs) tell the public what assets they hold. Best Fit Small Value · #1. iShares Morningstar Small-Cap Value ETF ISCV · #2. Vanguard Russell Value ETF VTWV · #3. Vanguard Small-Cap Value ETF VBR · #4. AVUV is multi-factor efficient, with screening rules that not only give you excellent concentration in small and value factors, but also higher. It invests in value stocks of small-cap companies. The fund seeks to benchmark the performance of its portfolio against the Russell Value Index. American. The 5 Top Performing Small Cap Value ETFs of ; FYT · First Trust Small Cap Value AlphaDEX Fund, % ; AVUV · Avantis U.S. Small Cap Value ETF, % ; RZV. Best Performing in Small Value Over the Last Year · ETF Details · Vanguard Small-Cap Value ETF Overview · About Vanguard Small-Cap Value ETF (VBR) · Assets Under. Prior to listing on June 14, , the following ETFs operated as mutual funds: US Equity ETF, US Core Equity 2 ETF, US Small Cap ETF, and US Targeted Value. The iShares S&P Small-Cap Value ETF seeks to track the investment results of an index composed of small-capitalization US equities that exhibit value. Hamilton Canadian Bank Mean Reversion Index ETF and RBC Canadian Bank Yield Index ETF were among the worst-performing ETFs in Q2 ETF Illustration. JPMorgan Active Small Cap Value ETF · THIS FUND IS DIFFERENT FROM TRADITIONAL ETFsTraditional exchange-traded funds (ETFs) tell the public what assets they hold. Best Fit Small Value · #1. iShares Morningstar Small-Cap Value ETF ISCV · #2. Vanguard Russell Value ETF VTWV · #3. Vanguard Small-Cap Value ETF VBR · #4.

The iShares S&P Small-Cap Value ETF seeks to track the investment results of an index composed of small-capitalization US equities that exhibit value. VBR | A complete Vanguard Small-Cap Value ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. Measures the performance of those Russell Index companies (the 2, smallest of the 3, largest publicly traded U.S. companies, based on total. Schwab U.S. Small-Cap ETF. Type: ETFs Symbol: SCHA Total Expense Ratio: %. The Avantis U.S. Small Cap Value ETF (AVUV) is one of the largest U.S.-listed small-cap ETFs with more than $11 billion in AUM. Avantis is part of American. Top 10 holdings ; J & J Snack Foods Corp. % ; Franklin Electric Co., Inc. % ; UMB Financial Corporation. % ; Eagle Materials Inc. %. XSVM Logo, Invesco S&P SmallCap Value with Momentum ETF ; Horizon Kinetics Inflation Beneficiaries ETF ; VTWV Logo, Vanguard Russell Value Index. Seeks to track the performance of the CRSP US Small Cap Value Index, which measures the investment return of small-capitalization value stocks. · Provides a. BEST-IN-CLASS TAX-DEFERRED ULTIMATE BUY & HOLD ETF PORTFOLIO ; Avantis International Small Cap Value ETF. AVDV. 10%. 6%. 4% ; Avantis Emerging Markets ETF. AVEM. Top 10 Holdings as of 09/02/ ; TMHC, Taylor Morrison Home Corp. % ; JXN, Jackson Financial Inc. % ; IVZ, Invesco Ltd. % ; DTM, DT Midstream Inc. Vanguard Small-Cap Value Index Fund (VSIAX)1 · Dimensional Tax-Managed U.S. Targeted Value Portfolio (DTMVX)2 · Dimensional U.S. Targeted Value Portfolio (DFFVX)3. Top 10 Holdings ; MATSON INC COMMON STOCK, MATX, G, USG, INDUSTRIALS ; JACKSON FINANCIAL INC A COMMON STOCK USD, JXN, M, USM Our pick for the best overall value ETF is IUSV, thanks to its combination of low fees and high diversification. By tracking the S&P Value Index, IUSV. IJR, iShares Core S&P Small-Cap ETF, Blackrock ; IWM, iShares Russell ETF, Blackrock ; VB, Vanguard Small-Cap ETF, Vanguard ; VBR, Vanguard Small-Cap Value. Over time, this performance differential would have resulted in an investment value four times that of large cap value. Investors looking to improve their. International Small Cap Value ETFs offer investors exposure to stocks with market caps between $ million and $2 billion located outside the United States. Movers in US Small Cap ; RWJ. Invesco S&P SmallCap Revenue ETF, +%, +% ; VTWO. Vanguard Russell ETF, +%, +%. InfraCap REIT Preferred ETF (NYSE: PFFR): Exchange-Traded Funds (ETF): The value of an ETF may be more volatile than the underlying portfolio of securities it. IJR, iShares Core S&P Small-Cap ETF, Blackrock ; IWM, iShares Russell ETF, Blackrock ; VB, Vanguard Small-Cap ETF, Vanguard ; VBR, Vanguard Small-Cap Value. VBR | A complete Vanguard Small-Cap Value ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing.

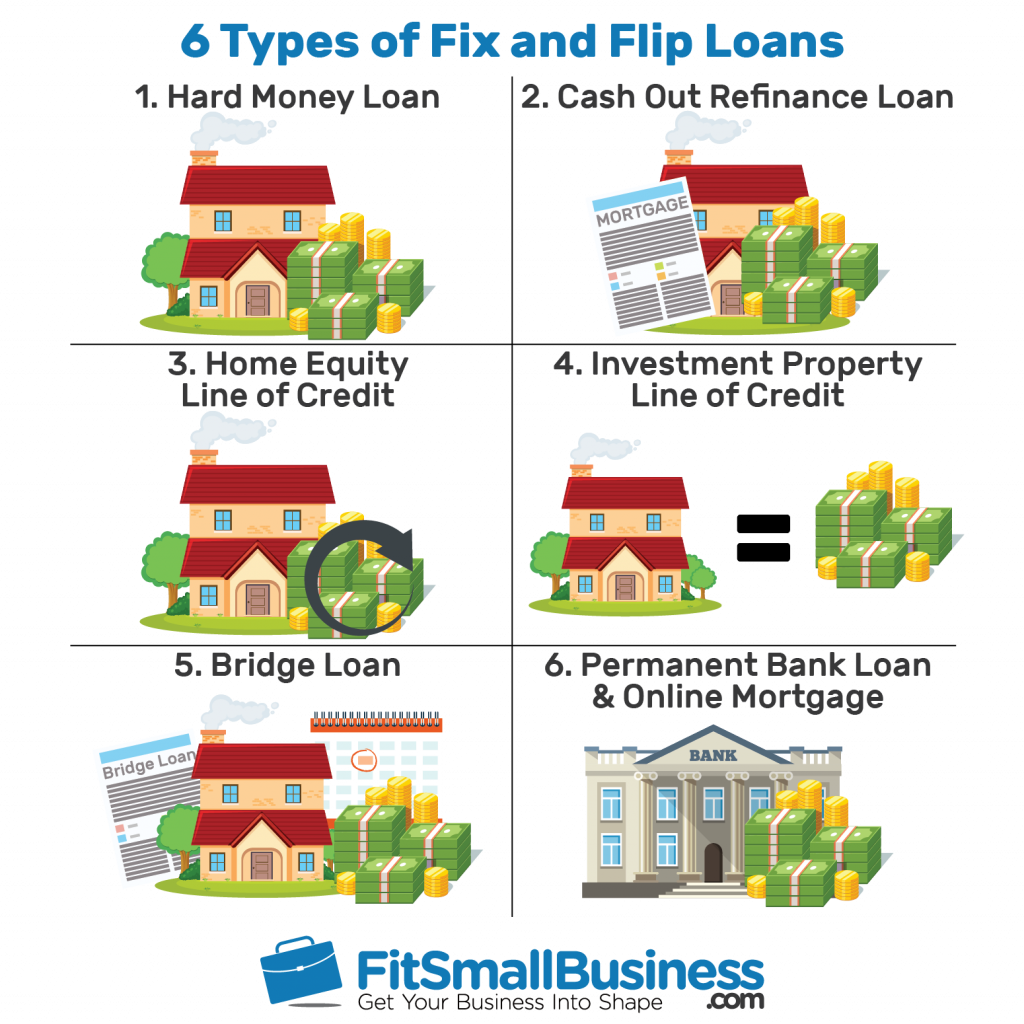

What Is A Fix And Flip Loan

Fix & flip loans are short-term, real estate loans designed to help an investor purchase & renovate property to sell it at a profit with funding up to 90%. Explore our competitive fix and flip loans at Westpark Loans. Get flexible financing options designed for real estate investors. Apply online today! The profit on fix and flip loans comes from the renovation of the property. A hard money lender will typically finance renovations as a part of the total loan. Plenty of options but the major groups of financing include HML' PML, self financing, HELOC from your primary residence, going in with a partner where they. ABL's fix and flip loan program and hard money rehab loans provide the funding for flipping that borrowers need to purchase and rehab a property. This guide isn't just about securing a fix-and-flip loan; it's an exploration of how to widen your financial avenues and seize new opportunities in real estate. Short-term fix & flip rehab property loans for residential real estate investors. No W2's or income verification required. month term. How does a fix and flip loan work? Fix and flip loans are secured by collateral, usually, the real estate property that is being purchased and renovated. This. Fix-and-flip loans are asset-based loans too. But, they are subject to more underwriting guidelines and criteria. While hard money loans focus solely on the. Fix & flip loans are short-term, real estate loans designed to help an investor purchase & renovate property to sell it at a profit with funding up to 90%. Explore our competitive fix and flip loans at Westpark Loans. Get flexible financing options designed for real estate investors. Apply online today! The profit on fix and flip loans comes from the renovation of the property. A hard money lender will typically finance renovations as a part of the total loan. Plenty of options but the major groups of financing include HML' PML, self financing, HELOC from your primary residence, going in with a partner where they. ABL's fix and flip loan program and hard money rehab loans provide the funding for flipping that borrowers need to purchase and rehab a property. This guide isn't just about securing a fix-and-flip loan; it's an exploration of how to widen your financial avenues and seize new opportunities in real estate. Short-term fix & flip rehab property loans for residential real estate investors. No W2's or income verification required. month term. How does a fix and flip loan work? Fix and flip loans are secured by collateral, usually, the real estate property that is being purchased and renovated. This. Fix-and-flip loans are asset-based loans too. But, they are subject to more underwriting guidelines and criteria. While hard money loans focus solely on the.

Using HouseMax for your fix and flip loans will allow you to do up to 5 times as many deals, compared to cash. The lender will base the loan on a percentage of. Fix and flip loans are incredibly versatile. You have the option to use the funds to purchase single-family homes, multi-family residences, commercial buildings. A fix and flip loan is short-term financing that real estate investors use to buy and renovate a property in order to resell it for a profit. Apply for a home equity agreement with Unlock. Choosing a financing method for your next house flipping project requires careful consideration of your finances. Fix and flip loans (aka hard money loans or “rehab loans”) are short term loans specifically designed for the financing of real estate investments. Our Fix and Flip Loan Program offers a short-term, interest-only loan to purchase and rehab an investment property. As a private mortgage lender offering. CIVIC's fix and flip loans allow you to purchase a property under market value, rehab it, and then re-sell it as quickly as possible. Fund your next renovation Fix & flip loans at Groundfloor Learn how Groundfloor can help you with your next flip and flip project. What are fix & Flip Loans. Fix and flip loans in Florida allow you to secure funding to invest in a property you aim to renovate and sell for profit. Fix and flip loans are typically utilized to renovate properties in disrepair. As real estate investors purchase a distressed or foreclosed property, fixer. Fix-and-flip loan options for commercial real estate include hard money loans, investment property lines of credit, and more. Financing from $ to $ Loans for investors who are buying distressed properties, rehabbing, and selling. Sensible, flexible, and fast! A fix and flip loan is a short-term loan used to acquire a one-to-four family dwelling and then to renovate it in anticipation of an immediate sale. These short-term real estate loans help investors purchase and renovate property with the goal of selling at a profit within 12 to 18 months. The fix and flip loan is a great alternative to traditional construction financing. It allows you to purchase a home, renovate it, and then sell it for profit. Beginner Fix & Flip · Bridge. A short-term loan used to acquire or refinance a property when conventional financing is not available or will take too long to. Our Fix & Flip loans help you buy & rehab dilapidated homes in Maryland, Virginia, and Washington, DC. Our loans are specifically designed to help real estate. Fix and flip loans are short-term loans, typically lasting between 6 to 18 months. At Larry the Lender we offer 6 and 12 month notes. These loans are designed. Fix and Flip Loans California. Hard Money Rehab Loan Lenders. 40 Years of Experience. Fixed Rates from %. Points from No Junk Fees. Fix and flip loans, also known as hard money rehab loans, investment property rehab loans or house flipping loans, are short-term financing tools for real.

How Much Is Pmi In Pa

The cost of mortgage insurance varies based on your loan amount, loan-to-value ratio, and credit score. According to Freddie Mac, most borrowers pay between $ Taxes Insurance PMI FHA. Today's FHA Loan Rates. We use your calculator inputs Pennsylvania, Puerto Rico, Rhode Island, South Carolina, South Dakota. Use our mortgage calculator with PMI built directly into it! Get accurate estimates for your monthly mortgage payments if you will be required to have. Pennsylvania. U.S. Department of Veterans Affairs (VA) Mortgages - helps What is Private Mortgage Insurance and how much will it cost? Private. PMI has been a large money-maker for the mortgage lenders. The amount of the insurance often $$50 per month for a $, house is commonly rolled into the. The cost of PMI depends on the loan to value ratio and the borrower's credit score. PMI for a 95% loan will cost % for a borrower with a Use this calculator to estimate your monthly private mortgage insurance premium based on your down payment amount. One such cost is private mortgage insurance (PMI), an additional fee that safeguards the lender in the event of borrower default. For conventional loans, PMI. Use SmartAsset's free Pennsylvania mortgage loan calculator to determine your monthly payments, including PMI, homeowners insurance, taxes, interest and. The cost of mortgage insurance varies based on your loan amount, loan-to-value ratio, and credit score. According to Freddie Mac, most borrowers pay between $ Taxes Insurance PMI FHA. Today's FHA Loan Rates. We use your calculator inputs Pennsylvania, Puerto Rico, Rhode Island, South Carolina, South Dakota. Use our mortgage calculator with PMI built directly into it! Get accurate estimates for your monthly mortgage payments if you will be required to have. Pennsylvania. U.S. Department of Veterans Affairs (VA) Mortgages - helps What is Private Mortgage Insurance and how much will it cost? Private. PMI has been a large money-maker for the mortgage lenders. The amount of the insurance often $$50 per month for a $, house is commonly rolled into the. The cost of PMI depends on the loan to value ratio and the borrower's credit score. PMI for a 95% loan will cost % for a borrower with a Use this calculator to estimate your monthly private mortgage insurance premium based on your down payment amount. One such cost is private mortgage insurance (PMI), an additional fee that safeguards the lender in the event of borrower default. For conventional loans, PMI. Use SmartAsset's free Pennsylvania mortgage loan calculator to determine your monthly payments, including PMI, homeowners insurance, taxes, interest and.

PA, RI, SC, SD, TN, TX, UT, VA, VT, WA, WI, WV, WY. Select the Term of the Loan: 10 years, 15 years, 20 years, 25 years, 30 years, Interest-Only, 40 years, House Price, $, ; Loan Amount with Upfront MIP, $, ; Down Payment, $17, ; Upfront MIP, $8, ; Total of Mortgage Payments. PMI typically amounts to about one-half of one percent of your mortgage amount annually, according to the Mortgage Bankers Association, and the premium payment. PMI costs vary from insurer to insurer, and from plan to plan. Buyers that have at least 5% down can pay approximately % times the annual loan amount. PMI is calculated as a percentage of your original loan amount and can range from % to % depending on your down payment and credit score. Once you reach. Also called private mortgage insurance (PMI). Escrow account. An escrow account may be required to cover the future payments for items like homeowners insurance. How much does PMI cost? The cost of PMI can vary depending on several factors, such as the loan amount, down payment, credit score, and the specific PMI. Periodically PMI chapters adjust their annual chapter membership fees. Your chapter fee is based upon the rate valid at the start date of your chapter. The cost of mortgage insurance varies based on your loan amount, loan-to-value ratio, and credit score. According to Freddie Mac, most borrowers pay between $ How much does PMI cost? The amount you'll pay depends on the size of your loan, the amount of your down payment and your credit score. Example: $, loan. Many customers ask us if FHA loans have mortgage insurance which they often call "PMI," which stands for private mortgage insurance. You are required to pay. Buyers with a 5% down payment can expect to pay a premium of approximately % times the annual loan amount, $ monthly for a $, purchase price. But. The cost can vary from borrower to borrower and generally runs between % and 2% of the loan amount of the mortgage. There are similar requirements when you. If you're able to put at least 20% of the home price towards your down payment, you'll be able to avoid PMI (private mortgage insurance). Even if you can't. Private mortgage insurance: If your down payment is less than 20% of the home's purchase price, you'll likely pay mortgage insurance. It protects the lender in. PMI premiums can be hefty, generally ranging from % to % of your original loan amount. How much you'll actually pay depends on factors like your down. One such cost is private mortgage insurance (PMI), an additional fee that safeguards the lender in the event of borrower default. For conventional loans, PMI. PA, it would depend on bank. Wouldn't hurt to ask. I ended up In my experience, PMI adds about as much as week-over-week mortgage. The PMI amount is determined by many different factors, similar to your interest rate Philadelphia, PA Here is a full listing of Better Real. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes.

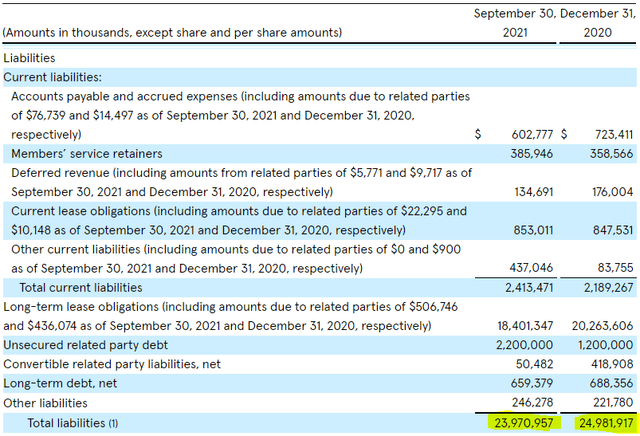

Wework Balance Sheet

WeWork is scheduled to report earnings on August 7, , and the estimated EPS forecast is €―. See an overview of income statement, balance sheet, and cash. WeWork Takes Strategic Action to Significantly Strengthen Balance Sheet and Further Streamline Real Estate Footprint. Nov 6. Financial News · WeWork's CEO. WEWORK INC. CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED). June 30,, December 31,. (Amounts in millions, except share and per share amounts), , See WeWork funding rounds, investors, investments, exits and more. Evaluate their financials based on WeWork's post-money valuation and revenue. WeWork Inc. (WE), Discounted Cash Flow Valuation. WeWork Inc. (WE) DCF Balance Sheet. The company has in cash and in debt, giving a net cash. Detailed balance sheet data for WeWork Inc - Class A (WEWKQ), with both restatements and as-reported data. Total liabilities on the balance sheet as of September $ B. According to WeWork's latest financial reports the company's total liabilities are. WeWork (WEWKQ) Financial Statements · WeWork Financial Overview · WeWork Earnings and Revenue History · WeWork Debt to Assets · WeWork Cash Flow · WeWork Forecast. As of first-quarter close, WeWork had locations across cities and 38 countries, as well as ,+ total memberships, including global enterprises. WeWork is scheduled to report earnings on August 7, , and the estimated EPS forecast is €―. See an overview of income statement, balance sheet, and cash. WeWork Takes Strategic Action to Significantly Strengthen Balance Sheet and Further Streamline Real Estate Footprint. Nov 6. Financial News · WeWork's CEO. WEWORK INC. CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED). June 30,, December 31,. (Amounts in millions, except share and per share amounts), , See WeWork funding rounds, investors, investments, exits and more. Evaluate their financials based on WeWork's post-money valuation and revenue. WeWork Inc. (WE), Discounted Cash Flow Valuation. WeWork Inc. (WE) DCF Balance Sheet. The company has in cash and in debt, giving a net cash. Detailed balance sheet data for WeWork Inc - Class A (WEWKQ), with both restatements and as-reported data. Total liabilities on the balance sheet as of September $ B. According to WeWork's latest financial reports the company's total liabilities are. WeWork (WEWKQ) Financial Statements · WeWork Financial Overview · WeWork Earnings and Revenue History · WeWork Debt to Assets · WeWork Cash Flow · WeWork Forecast. As of first-quarter close, WeWork had locations across cities and 38 countries, as well as ,+ total memberships, including global enterprises.

WeWork has a total shareholder equity of $B and total debt of $B, which brings its debt-to-equity ratio to %. Its total assets and total liabilities. Full history of WE WeWork Annual and Quarterly Balance Sheet Statements. Explore WeWork assets, debt, equity and cash. WeWork Inc (NYSE:WE) cash flow statement Income Statement Balance Sheet Cash Flow Statement. |. Revenue Breakdown. Cash. WeWork Inc. total assets from to Total assets can be defined as the sum of all assets on a company's balance sheet. Detailed balance sheet for WeWork (WEWKQ), including cash, debt, assets, liabilities, and book value. What did we do? Simple. Start with the present value of a company's operating lease liabilities, which all firms are now required to report on the balance sheet. Balance sheet and leverage ratio. Liquidity ratios. Table 5: Liquidity ratios of WeWork. Figure Change in quick ratio and current ratio (left). Balance sheet Report of WeWork. TheKredible's experts has summarized the Balance Sheet of WeWork for FY ₹ ₹ Add to cart. Profit and loss. WeWork (WEWKQ) financial statements, from SEC filings. View and download income statement, balance sheet and cash flow for free. View WeWork's (NYSE:WE) latest financials, balance sheet, income statement, cash flow statement, and 10K report at MarketBeat. Balance Sheet ; , , , ; , , , Discover WeWork's balance sheet and financial health metrics. From total debt, total equity, assets to cash-on-hand, interest coverage and more. WeWork Inc - Ordinary Shares - Class A balance sheet values as of Dec assets, liabilities, reserves, borrowings and history. Balance Sheet · Cash Flow Stmt · Key Ratios. Compare WE With Other Stocks. Annual Balance Sheet. Quarterly Balance Sheet. Sector, Industry, Market Cap, Revenue. WeWork Inc. (WEWKQ). Jun 11, - WEWKQ was delisted (reason: shares Balance Sheet · Cash Flow · Ratios. Annual; Quarterly; TTM. WeWork Income Statement. WEWORK INC financial statements, including revenue, expenses, profit, and loss The annual and quarterly earnings report below will help you understand the. WeWork (WE) - Net assets. Net assets on the balance sheet as of September $ B. According to WeWork's latest financial reports the company has -$. Debt Restructuring Deleverages the Balance Sheet and Improves Liquidity. NEW YORK, May 9, – WeWork Inc. (NYSE: WE) ("WeWork"), the leading global. You can evaluate financial statements to find patterns among WeWork's main balance sheet or income statement drivers, such as, as well as many indicators such.

What Is Rsi Stock Market

:max_bytes(150000):strip_icc()/dotdash_final_Relative_Strength_Index_RSI_Jul_2020-01-98fcd0c032cb4f0da005c31c44440c90.jpg)

The values of the RSI oscillator, typically measured over a day period, fluctuate between zero and The Relative Strength Index indicates oversold market. Relative Strength Index (RSI) technical indicator guide. Learn the RSI formula, best practices for RSI settings, and proven RSI trading strategies to apply. The relative strength index (RSI) is a momentum indicator that measures recent price changes as it moves between 0 and The RSI provides short-term buy and. Relative Strength Index is an overbought/oversold indicator that attempts to predict trend reversal points. RSI is based on the observation that a stock. The Relative Strength Index is a popular momentum oscillator that compares upward movements in closing price to downward movements over a selected period. When a stock price is falling while RSI is rising, it indicates a reversion bounce is impending. This is best used when new highs or lows are being made in the. The Relative Strength Index (RSI) is a leading indicator. This quality can be observed by using trendlines on the RSI chart and trading its break. The Relative Strength Index of any stock or security can help traders like you understand the momentum of an asset. It can then help you make sound trading. RSI compares the magnitude of recent gains with recent losses over a certain period, usually 14 days. It helps traders identify overbought and oversold market. The values of the RSI oscillator, typically measured over a day period, fluctuate between zero and The Relative Strength Index indicates oversold market. Relative Strength Index (RSI) technical indicator guide. Learn the RSI formula, best practices for RSI settings, and proven RSI trading strategies to apply. The relative strength index (RSI) is a momentum indicator that measures recent price changes as it moves between 0 and The RSI provides short-term buy and. Relative Strength Index is an overbought/oversold indicator that attempts to predict trend reversal points. RSI is based on the observation that a stock. The Relative Strength Index is a popular momentum oscillator that compares upward movements in closing price to downward movements over a selected period. When a stock price is falling while RSI is rising, it indicates a reversion bounce is impending. This is best used when new highs or lows are being made in the. The Relative Strength Index (RSI) is a leading indicator. This quality can be observed by using trendlines on the RSI chart and trading its break. The Relative Strength Index of any stock or security can help traders like you understand the momentum of an asset. It can then help you make sound trading. RSI compares the magnitude of recent gains with recent losses over a certain period, usually 14 days. It helps traders identify overbought and oversold market.

Many investors use this indicator to help identify whether a stock is overbought or oversold.

An RSI trading strategy is a set of rules and techniques that utilises the RSI indicator to identify potential trading entries based on overbought and oversold. The relative strength index (RSI) is a straightforward indicator for identifying when an equity has been overbought or oversold following recent price actions. The relative strength index (RSI) is a momentum indicator used in technical analysis that examines the size of recent price fluctuations in order to determine. It is a key tool used in technical analysis, assessing the momentum of assets to gauge whether they are in overbought or oversold territory. To calculate RSI. By combining RSI with moving averages and candlestick patterns, traders can obtain a more comprehensive view of the market and make more informed trading. Highlights · RSI is a technical analysis tool that measures price movement strength and identifies overbought and oversold conditions in financial markets. · RSI. The RSI formula can be calculated using the mean changes in closing prices for a certain period. = Umean / Dmean. Where,. Umean = mean of all the upward. The RSI is always between 0 and , with stocks above 70 considered overbought and stocks below 30 oversold. Divergence between the price and RSI can also be. The RSI is a comparison between the days that a stock finishes up against the days it finishes down. This indicator is a popular tool in momentum trading. Discover the Relative Strength Index (RSI) with our comprehensive guide and utilize this essential technical indicator to optimize your trading strategies. The relative strength index (RSI) is a technical indicator used in the analysis of financial markets. It is intended to chart the current and historical. Traders often use RSI to generate buy or sell signals when it diverges from the price action. Readings above 70 indicate overbought conditions, while readings. It's called the Relative Strength Index, or RSI for short, and its purpose is to measure the speed and size of a stock's price movements, giving investors a. The Relative Strength Index (RSI) is a technical indicator that traders could use to examine how the price is performing over a certain period. The RSI in the stock market is a technical analysis tool used to measure the strength of an asset's price movement over a certain period of time. The RSI. DEFINITION: Relative Strength Index (acronym RSI) is one of the most extensively used momentum oscillators in the realm of technical analysis of stocks. Determine the relative strength of the asset by dividing the average gain by the average loss over the previous 14 trading days; Finally, enter the relative. Oversold and Overbought The general idea is that when the RSI shows extremely high or extremely low values (higher than 70 or lower than 30), the price is. RSI is a type of oscillating indicator. It offers investors a way of determining whether a given stock might be oversold or overbought. If a stock is. Some traders use more extreme levels (80/20) to reduce false readings. Sign up for our newsletter. Get daily trading ideas, educational videos and platform.

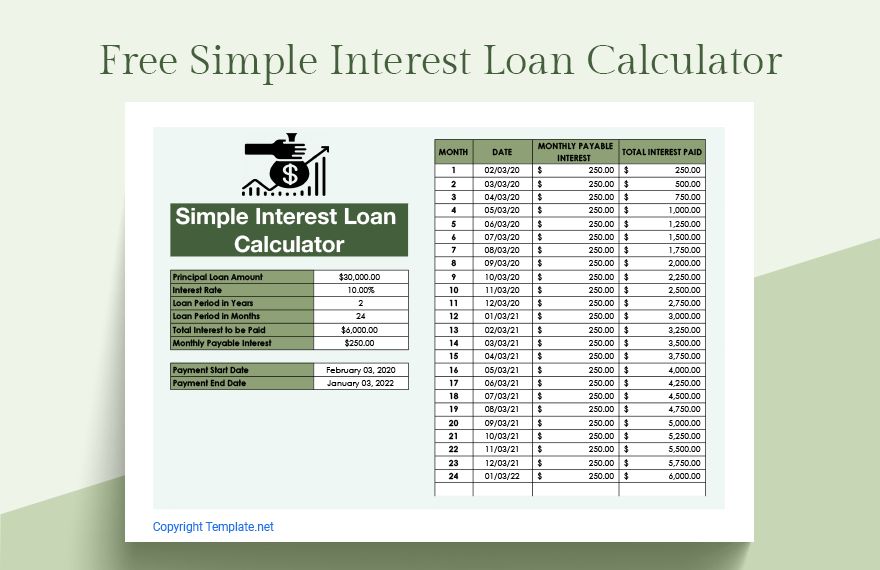

How To Add Interest On A Loan

APR = (((Interest charges + fees) ÷ Loan amount) ÷ Number of days in loan term x ) x A formula shows how to calculate APR. First, add interest charges. The calculation is an estimate of what you will pay towards an auto loan. Use the amount as a reference or guideline; it may not be the same amount you receive. To start, you'd multiply your principal by your annual interest rate, or $10, × = $ Then, you'd multiply this value by the number of years on the. Simple loan between two dates (simple interest) · Simple loan between two dates (compound interest) · Loan with regular payments (refunds) · Irregular (complex). Discussion · make a simple interest loan which you pay off with a lump sum payment at the end of the loan, letting the interest on the initial principal. On the first line, select the liability account for the loan from the Category dropdown. · On the second line, select the expense account for the interest from. “Add-on interest” is a calculation that Margill Loan Manager (MLM) handles easily to compute the true interest rate (APR). For example, a car dealer advertises. To calculate a monthly interest payment based on a per annum interest rate, multiply the principal basis for the loan by the annual interest rate. · Divide the. include interest, which is the profit that banks or lenders make on loans. Interest rate is the percentage of a loan paid by borrowers to lenders. For most. APR = (((Interest charges + fees) ÷ Loan amount) ÷ Number of days in loan term x ) x A formula shows how to calculate APR. First, add interest charges. The calculation is an estimate of what you will pay towards an auto loan. Use the amount as a reference or guideline; it may not be the same amount you receive. To start, you'd multiply your principal by your annual interest rate, or $10, × = $ Then, you'd multiply this value by the number of years on the. Simple loan between two dates (simple interest) · Simple loan between two dates (compound interest) · Loan with regular payments (refunds) · Irregular (complex). Discussion · make a simple interest loan which you pay off with a lump sum payment at the end of the loan, letting the interest on the initial principal. On the first line, select the liability account for the loan from the Category dropdown. · On the second line, select the expense account for the interest from. “Add-on interest” is a calculation that Margill Loan Manager (MLM) handles easily to compute the true interest rate (APR). For example, a car dealer advertises. To calculate a monthly interest payment based on a per annum interest rate, multiply the principal basis for the loan by the annual interest rate. · Divide the. include interest, which is the profit that banks or lenders make on loans. Interest rate is the percentage of a loan paid by borrowers to lenders. For most.

If you know the amount of a loan and the amount of interest you would like to pay, you can calculate the largest interest rate you are willing to accept. Keep in mind, this doesn't include income from an RRSP, TFSA, or if your investment income is considered a capital gain. Interest paid on a policy loan, if. In a principal + interest loan, the principal (original amount borrowed) is divided into equal monthly amounts, and the interest (fee charged for borrowing) is. At the beginning of the loan, a larger share of the payment is applied to interest because most of the principal balance has not been repaid yet, so a larger. Simple interest is an interest charge that borrowers pay lenders for a loan. It is calculated using the principal only and does not include compounding. When you're entering a loan payment in your account it counts as a debit to the interest expense and your loan payable and a credit to your cash. Just because a large payment was made does not mean interest stops adding up. If a payment is skipped, the principal balance will remain the same for a while. Interest = interest rate / 12 * starting principal. Principal payment = monthly payment - interest. Ending principal = starting principal -. Looking out for a personal loan? Using the formulae mentioned in this article, you can calculate personal loan interest easily. Read this blog to know more. To calculate the interest due on a late payment, the amount of the debt should be multiplied by the number of days for which the payment is late. Use the formula Interest = P x R x T, where P is the principal, R is the interest rate, and T is the term of the loan. For example, to find the interest of a. This formula consists of multiplying your loan balance by the number of days since you made your last payment and multiplying that result by the interest rate. Interest on a loan, such as a car, personal or home loan, is usually calculated daily based on the unpaid balance. This typically involves multiplying your loan. make a substantial investment; make an important purchase; commit to your children's education; consolidate higher interest rate debt. When you use RBC Royal. Generally, the interest payment is related to the principal amount that is owed to the lender. Whenever a principal payment occurs, the balance of the principal. To calculate the interest due on your loan, please follow the steps below: 1. Obtain the new principal balance of your loan from your Online Banking Account. How to calculate home loan interest repayments · Convert the interest rate to a decimal by dividing the percentage by · To obtain the annual interest charge. Each day, we multiply your loan balance by your interest rate, and divide this by days (even in leap years). This is your daily interest charge. · At the end. Interest is added to your loan balance monthly. If you have Canada student put your loans in default; lower your credit score; send your loans to. Interest on a loan, such as a car, personal or home loan, is usually calculated daily based on the unpaid balance.

Neural Networks In Finance

Neural networks have been shown to be a promising tool for forecasting financial time series. Several design factors significantly impact the accuracy of neural. In the realm of financial time series forecasting, Convolutional Neural Networks (CNNs) have emerged as a powerful tool for analyzing and predicting stock. The book shows how neural networks can be applied to many real world financial problems. The book pays particular interest to international finance. The book. Traditional statistical methods pose challenges in data analysis due to irregularity in the financial data. To improve accuracy, financial researchers use. Artificial Neural Networks in Finance and Manufacturing presents many state-of-the-art and diverse applications to finance and manufacturing, along with. Read reviews from the world's largest community for readers. Neural Networks in Finance and Investing is a revised and expanded edition of the first book t. Neural Networks in Finance and Investing is a revised and expanded edition of the first book to exclusively address the use of neural networks in the. Artificial Neural Networks in Finance and Manufacturing presents many state-of-the-art and diverse applications to finance and manufacturing, along with. chernikasite.ru: Neural Networks in Finance and Investing: Using Artificial Intelligence to Improve Real-World Performance: Trippi, Robert R. Neural networks have been shown to be a promising tool for forecasting financial time series. Several design factors significantly impact the accuracy of neural. In the realm of financial time series forecasting, Convolutional Neural Networks (CNNs) have emerged as a powerful tool for analyzing and predicting stock. The book shows how neural networks can be applied to many real world financial problems. The book pays particular interest to international finance. The book. Traditional statistical methods pose challenges in data analysis due to irregularity in the financial data. To improve accuracy, financial researchers use. Artificial Neural Networks in Finance and Manufacturing presents many state-of-the-art and diverse applications to finance and manufacturing, along with. Read reviews from the world's largest community for readers. Neural Networks in Finance and Investing is a revised and expanded edition of the first book t. Neural Networks in Finance and Investing is a revised and expanded edition of the first book to exclusively address the use of neural networks in the. Artificial Neural Networks in Finance and Manufacturing presents many state-of-the-art and diverse applications to finance and manufacturing, along with. chernikasite.ru: Neural Networks in Finance and Investing: Using Artificial Intelligence to Improve Real-World Performance: Trippi, Robert R.

Neural Networks or Machine Learning for Finance/Stocks. Neural Networks in Finance and Investing is a revised and expanded edition of the first book to exclusively address the use of neural networks in the. Despite the pervasiveness of linear models in tradi- tional financial analysis (e.g., the Sharpe-Lintner capital asset pricing model and Ross's arbitrage pric-. Neural Networks in Finance and Investing: Using Artificial Intelligence to Improve Real-World Performance - ISBN - ISBN Artificial neural networks are especially appealing in finance, banking, and insurance because of their high-quality data. Buy Artificial Neural Networks in Finance and Manufacturing (Hardcover) at chernikasite.ru This book explores the intuitive appeal of neural networks and the genetic algorithm in finance. It demonstrates how neural networks used in combination. We discuss the theoretical background and develop a step-by-step implementation of a toy model for a neural network using financial data. Neural Networks in Finance and Investing: Using A- Trippi, , hardcover ; Condition. Good ; Quantity. 1 available ; Item Number. ; Book Title. Purchase Neural Networks in Finance - 1st Edition. Print Book & E-Book. ISBN , This article will be an introduction on how to use neural networks to predict the stock market, in particular, the price of a stock (or index). This book explores the intuitive appeal of neural networks and the genetic algorithm in finance. It demonstrates how neural networks used in combination. Neural Networks in Finance and Investing: Using Artificial Intelligence to Improve Real-World Performance by Trippi, Robert R. - ISBN - ISBN. This research presents the analysis of neural network systems and how it is efficiently utilized for financial analysis and in particular for cash predictions. Item description from the seller Neural Networks in Finance: Gaining Predictive Edge in the Market (Academic Press Advanced Finance). Title: Neural Networks. A step-by-step technique for building a potentially profitable financial neural network is discussed and use of the tanh activation function is shown to. Neural Networks in Financial Engineering One of the most exciting applications of neural networks in recent times has been to improve investment performance. Abstract. In this paper, we discuss Artificial Neural Networks (ANNs), one of the most common and complex Machine Learning tools. After a non-technical. The financial industry is becoming more and more dependent on advanced computer technologies in order to maintain competitiveness in a global economy.

1 2 3 4 5