chernikasite.ru

News

What Is A Home Owners Loan

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

Other articles where Home Owners Loan Act is discussed: United States: The first New Deal: The Home Owners Loan Act established a corporation that. A refinance mortgage is a home loan that replaces your current mortgage with a new one. Homeowners often refinance to lower their payment, pay their loan off. Mortgages help people buy homes, allowing millions to achieve a coveted milestone. Explore what a mortgage loan is, how it works and how to get one. Eligibility Calculator Most people borrow the large amount of money they need to buy a home. This type of borrowing is called a first mortgage loan. There are. loan is available to eligible homebuyers in conjunction with a CHFA first mortgage loan. Owners & Property Managers · About Us · Contact Us · CHFA. Connect. MaineHousing offers First Home Loan mortgages through a statewide network of banks, credit unions and mortgage companies. A MaineHousing First Home Lender will. FHA loans have been helping people become homeowners since How do we do it? The Federal Housing Administration (FHA) - which is part of HUD - insures. Home Owners' Loan Act of , also known as An Act to Provide Emergency Relief with Respect to Home Mortgage Indebtedness, to Refinance Home Mortgages. The home is used as collateral. That means if you break the promise to repay your mortgage, the bank has the right to foreclose on your property. Your loan. Other articles where Home Owners Loan Act is discussed: United States: The first New Deal: The Home Owners Loan Act established a corporation that. A refinance mortgage is a home loan that replaces your current mortgage with a new one. Homeowners often refinance to lower their payment, pay their loan off. Mortgages help people buy homes, allowing millions to achieve a coveted milestone. Explore what a mortgage loan is, how it works and how to get one. Eligibility Calculator Most people borrow the large amount of money they need to buy a home. This type of borrowing is called a first mortgage loan. There are. loan is available to eligible homebuyers in conjunction with a CHFA first mortgage loan. Owners & Property Managers · About Us · Contact Us · CHFA. Connect. MaineHousing offers First Home Loan mortgages through a statewide network of banks, credit unions and mortgage companies. A MaineHousing First Home Lender will. FHA loans have been helping people become homeowners since How do we do it? The Federal Housing Administration (FHA) - which is part of HUD - insures. Home Owners' Loan Act of , also known as An Act to Provide Emergency Relief with Respect to Home Mortgage Indebtedness, to Refinance Home Mortgages. The home is used as collateral. That means if you break the promise to repay your mortgage, the bank has the right to foreclose on your property. Your loan.

The EHLP is designed to provide mortgage payment relief to eligible homeowners experiencing a drop in income of at least 15% directly resulting from involuntary. PHFA offers home purchase and refinance loans to qualified borrowers throughout Pennsylvania. Get more information on how to begin the process of buying a. It's available to first-time homebuyers, veterans or homebuyers who haven't owned a home within the past three years. · It's a dollar-for-dollar reduction on. OHFA also has a number of programs that assist first time buyers and others buying a home. Benefits include lower mortgage rates, down payment assistance, tax. A home loan is an agreed-upon sum of money loaned for the purpose of buying a house, apartment, condo, or any other residential property. Florida Housing offers a Homebuyer Program that offers year fixed rate first mortgage loans to first time homebuyers through participating lenders and. Best Mortgage Lenders for First Time Buyers. View Guide. Mortgages. Best What is a home equity loan? It indicates an expandable section or menu, or. Starting at $5,, this ongoing line of credit lets you borrow up to 65% of your home's value 1,2. And as long as you have available credit and make your. Home Buying Process for the First Time Homeowner · Step 1: Prepare Your Finances · Step 2: Shop for a Home · Step 3: Apply for a Mortgage · Step 4: Make an Offer. Loan Terms – A Homeownership Program Loan is a year, fixed rate mortgage loan. Up to % of the purchase price of the home can be financed. Low Down Home. This is in addition to your required down payment, and is in the form of a shared-equity mortgage with the Government of Canada. The First-Time Home Buyer. You must use the loan for a down payment (you can't use the loan for financing, closing or other costs). Help with your application. The Down Payment Assistance. Home Owners' Loan Act (HOLA) A federal statute that provides for the chartering and regulation of thrifts and thrift holding companies (12 U.S.C. The California Housing Finance Agency - CalHFA offers a variety of loan programs to help homebuyers and first time homebuyers purchase a home in California. mortgages for first-time homebuyers and borrowers who have not owned a home in 3 years Owners & Property Managers · About Us · Contact Us · CHFA. Connect. What is a homeowner loan? A homeowner loan is a form of secured borrowing. It allows you to borrow a large lump sum of money using your property as security. The first mortgage loan is a competitive year, fixed-rate government-insured loan (FHA/VA/USDA) or conventional mortgage, originated through an NJHMFA. The HAF Program in the State of CT is known as MyHomeCT and is being administered by the CHFA. Homeowners can apply for up to $50, in grant assistance. Getting prequalified (you can prequalify for a Bank of America mortgage online) will provide you with an estimate of how much you can borrow before you start. Home Lending Customer Service. Go to Chase mortgage services to manage your account. Make a mortgage payment, get info on your escrow, submit an insurance claim.

Credit Freeze How To Do It

A credit freeze keeps new creditors from accessing your credit report without your permission. If you activate a credit freeze, an identity thief cannot take. 1. Contact TransUnion, Equifax, and Experian online, by phone, or by mail. · 2. Provide all information requested, including your Social Security number. Learn how to freeze your credit for free with TransUnion. Also known as a security freeze, it can help prevent new accounts from being opened in your name. Frequent moves and deployments can make identifying and addressing identity theft extra challenging for service members. Get a step ahead and take advantage. How do I place a security freeze? To place a freeze, you must contact each of the three credit bureaus. You can request the freeze by mail. See the sample. How to “Freeze” Your Credit Report A “credit freeze," also known as a “security freeze," completely blocks the information on your credit report from would-be. Duration: A credit freeze lasts until you remove it. Cost: Free. How to place: Contact each of the three credit bureaus — Equifax, Experian, and TransUnion. A “security freeze” blocks access to your credit unless you have given your permission. This can prevent an identity thief from opening a new account or getting. What Does a Credit Freeze Do? When you put a credit freeze (sometimes called a security freeze) in place, new creditors can't review your credit reports to. A credit freeze keeps new creditors from accessing your credit report without your permission. If you activate a credit freeze, an identity thief cannot take. 1. Contact TransUnion, Equifax, and Experian online, by phone, or by mail. · 2. Provide all information requested, including your Social Security number. Learn how to freeze your credit for free with TransUnion. Also known as a security freeze, it can help prevent new accounts from being opened in your name. Frequent moves and deployments can make identifying and addressing identity theft extra challenging for service members. Get a step ahead and take advantage. How do I place a security freeze? To place a freeze, you must contact each of the three credit bureaus. You can request the freeze by mail. See the sample. How to “Freeze” Your Credit Report A “credit freeze," also known as a “security freeze," completely blocks the information on your credit report from would-be. Duration: A credit freeze lasts until you remove it. Cost: Free. How to place: Contact each of the three credit bureaus — Equifax, Experian, and TransUnion. A “security freeze” blocks access to your credit unless you have given your permission. This can prevent an identity thief from opening a new account or getting. What Does a Credit Freeze Do? When you put a credit freeze (sometimes called a security freeze) in place, new creditors can't review your credit reports to.

You need to sign into each of the national credit bureaus and request your credit be unfrozen. As with freezing your credit, federal law requires the agencies. You have two primary options for freezing your credit files with the three major credit bureaus. You can do it by phone or online, whichever you're more. Credit freezes restrict access to your credit report and assist with preventing new lines of credit from being opened in your name. If you need access to your. A security freeze is a step you take to prevent credit, loans and services from being opened in your name without your permission. You can also manage your freeze by phone: call us at () You'll be required to give certain information to verify your identity. You'll also have. loan or any other type of loan), you can freeze your credit report. Unlike Do If You Suspect Abuse Opting Out of Marketing Offers · Protecting Your. The quickest and easiest way to unfreeze your credit report is to contact the credit bureau (or bureaus) you used to freeze your credit either online or by. A credit freeze, also called a security freeze, prevents a credit reporting agency from releasing your credit report to others, without affecting your credit. The security freeze is designed to prevent credit, loans, and services from being approved in your name without your consent. Freezing your credit locks down your files, thereby preventing credit checks. That means unauthorized individuals cannot obtain credit cards, loans, or anything. credit freezes free of charge. How do I place a security freeze? To place a freeze, you must contact each of the three credit bureaus directly. You may. How do I place, temporarily lift, or permanently remove a security freeze? · Online, by creating a myEquifax account. You can check the status of your security. A security freeze means that your credit file cannot be shared with potential creditors, insurance companies or employers doing background checks. Most. Depending on state law, you may be charged a fee each time your freeze is lifted. To end your freeze permanently, you need to submit a request to the three. Do you want to limit access to your Innovis Credit Report? A Security Freeze prevents your Innovis Credit Report from being accessed by most third parties in. If I freeze with TransUnion do I need to freeze with the other bureaus? Yes. You can freeze your TransUnion credit report with us, but to freeze your other. A security freeze gives you complete control of your credit file and is the absolute best way to protect your credit and identity. You can do this online or by mail or by phone with all three credit bureaus: Experian and Transunion, and Equifax. Each credit bureau will provide you with your. As part of it you should be issued a PIN by each bureau. Make sure to keep this in a safe place since it is what allows you to temporarily or. A “credit freeze” prevents new creditors from accessing a person's credit report. Without seeing a person's credit history, most creditors will not open new.

What Investment Has The Lowest Risk

The major investment asset classes include savings accounts, savings bonds, equities, debt, derivatives, real estate, and hard assets. Each has a different risk. Risk: How to avoid taking more than you need · If retirement is still far away. In general, if you're many years away from retiring, more of your investments. Low-risk vehicles such as certificates of deposit, for example, that mature about the time you'll need the cash, or a money-market fund that allows you to. Investing should be seen as a medium-to-long-term commitment, where you should be prepared to invest for at least 5 years. Because of this, having 3 to 6 months. Blue chip - A high-quality, relatively low-risk investment; the term usually Preferred stock - A class of stock with a fixed dividend that has. CDs are among the safest investments out there since there is virtually no risk of loss of principal. Moreover, they come with FDIC insurance of up to $, The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional. These are the simplest and most popular forms of investment because bank fixed deposits are considered to be the safest and best options for long term. Cash Equivalents. Cash equivalents are the safest types of investments and include things like money market funds or Treasury bills. They offer low returns but. The major investment asset classes include savings accounts, savings bonds, equities, debt, derivatives, real estate, and hard assets. Each has a different risk. Risk: How to avoid taking more than you need · If retirement is still far away. In general, if you're many years away from retiring, more of your investments. Low-risk vehicles such as certificates of deposit, for example, that mature about the time you'll need the cash, or a money-market fund that allows you to. Investing should be seen as a medium-to-long-term commitment, where you should be prepared to invest for at least 5 years. Because of this, having 3 to 6 months. Blue chip - A high-quality, relatively low-risk investment; the term usually Preferred stock - A class of stock with a fixed dividend that has. CDs are among the safest investments out there since there is virtually no risk of loss of principal. Moreover, they come with FDIC insurance of up to $, The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional. These are the simplest and most popular forms of investment because bank fixed deposits are considered to be the safest and best options for long term. Cash Equivalents. Cash equivalents are the safest types of investments and include things like money market funds or Treasury bills. They offer low returns but.

Which investments are the safest? · 1. Savings bonds · 2. Treasury bonds, bills, notes & TIPS · 3. Money market accounts · 4. High-yield savings accounts · 5. Short-. Certificates of deposits, or CDs, are another popular, low-risk investment that are useful for generating fixed income. CDs are savings products that typically. This can be contrasted with “safe” investments such as money market mutual funds or GICs where there is a very low risk that you will lose your initial. Fixed income investments generally carry lower risk than stocks. They also function well as a way to generate income or value from your investments on a. All investments carry some degree of risk. Stocks, bonds, mutual funds and exchange-traded funds can lose value—even their entire value—if market conditions. All investments carry some degree of risk. Stocks, bonds, mutual funds and exchange-traded funds can lose value—even their entire value—if market conditions. High-yield bond securities are typically subject to greater risk and price volatility than funds which invest in higher-rated securities. Balanced Funds –. Money Market Funds A money market fund is a type of mutual fund that typically has low risks. They work by investing in high-quality, short-term corporate or. You should invest in a very very low management fee mutual fund that tracks the S&P index. One like Fidelity Index Fund. Lots of words. Our framework for cash investing takes into account risk tolerance, investment horizon, and funding levels. low, and be disciplined. Article. How to. 5 types of low-risk investments ; Treasury bonds. 20 to 30 years. Treasury bills. Four to 52 weeks. Treasury notes ; Liquidity. Low return. Regular income. It may. Does this mean you should avoid all high-risk investments? For most people low-risk at the top to higher risk at the bottom. Another way of looking. Cash equivalents are the safest types of investments and include things like money market funds or Treasury bills. They offer low returns but carry the least. All have higher risks and potentially higher returns than savings products. Over many decades, the investment that has provided the highest average rate of. CDs and bonds are a low risk option, but you have to tie your money up for a period of time until they mature. Additionally, they don't. Through the investment strategy known as “dollar cost averaging,” you can protect yourself from the risk of investing all of your money at the wrong time by. Domestic Large company stocks are considered to have the lowest risk among stock categories. Domestic Small company stocks historically have higher risk than. As the name suggests, low-risk mutual funds are those investment options that carry minimal risk and a stable return assurance. Investments are primarily. What is a low risk investment? Precisely what it says on the tin. An investment where there is perceived to be just a slight chance of losing some or all of. You accept that there is an increased risk of capital loss over investing in more low risk investments. Medium risk investments can fluctuate in value more.

Navy Federal Limit

What are the deposit and transaction limits? All accounts have a $50, aggregate limit per Business Day. Transactions are not limited for business. The month Certificate Special is also an “add-on” CD, allowing unlimited additional deposits (subject to $k maximum balance) throughout the term. There is. This is my 3rd credit card at Navy Federal. I have the Visa signature Card with a $22, limit and a Platinum Card with a $3, limit and now. You must be a Navy Federal member to apply. If you have any questions while completing this application, please call our hour 7 days a week Consumer Loan. Alternatives to Navy Federal Credit Union · Up to $5, for checking lines of credit; · maximum amounts not specified for other financing options. NFCU. BANCO. NAPOLI. CB. The daily withdrawal limit for NFCU debit cards is $1, Page 5. Federally Insured by NCUA. 2 ATMs Support Site. ACCESS TO YOUR MONEY. We generally grant credit limit increases on an existing credit card account no more than once every six months. Transfers to Navy Federal loans from a checking account at another financial institution may be requested for a minimum of $ to a maximum of $10, per. Manage Your Debit Card. Access the essential resources you need to successfully manage your Navy Federal Debit Card. What are the deposit and transaction limits? All accounts have a $50, aggregate limit per Business Day. Transactions are not limited for business. The month Certificate Special is also an “add-on” CD, allowing unlimited additional deposits (subject to $k maximum balance) throughout the term. There is. This is my 3rd credit card at Navy Federal. I have the Visa signature Card with a $22, limit and a Platinum Card with a $3, limit and now. You must be a Navy Federal member to apply. If you have any questions while completing this application, please call our hour 7 days a week Consumer Loan. Alternatives to Navy Federal Credit Union · Up to $5, for checking lines of credit; · maximum amounts not specified for other financing options. NFCU. BANCO. NAPOLI. CB. The daily withdrawal limit for NFCU debit cards is $1, Page 5. Federally Insured by NCUA. 2 ATMs Support Site. ACCESS TO YOUR MONEY. We generally grant credit limit increases on an existing credit card account no more than once every six months. Transfers to Navy Federal loans from a checking account at another financial institution may be requested for a minimum of $ to a maximum of $10, per. Manage Your Debit Card. Access the essential resources you need to successfully manage your Navy Federal Debit Card.

IRA Contribution Limit & Rules · Traditional and Roth IRA Contribution Limit Chart · SEP IRA Contribution Limits · ESA Contribution Limits · Navy Federal. NFCU. BANCO. NAPOLI. CB. The daily withdrawal limit for NFCU debit cards is $1, Page 5. Federally Insured by NCUA. 2 ATM Support Site. ACCESS TO YOUR MONEY. If you are talking about a direct deposit with Navy Federal Credit Union, that is normal. You will see the pending deposit on the NFCU. Learn more about savings account options at Navy Federal. Can I have more than one savings or checking account? Yes. There's no limit to the number of savings. Fee. The fee for both domestic and international outgoing transfers is $ · Limit. The maximum dollar amount per transaction is $10, · Notification. How Much Deposit Do I Need for a Credit Limit? The minimum deposit for the Navy Federal Secured credit card is $ However, you can deposit however much you. I have been with navy federal for over 33 years. I had a largo sum of money. I needed to withdraw $ from a atm. The limit is $ on a debit card. But they. For payments processed within minutes, the daily limit is $1, and the day limit is $3, For standard processing ( days), the daily and day limits. Navy Federal Credit Union because your Navy Federal debit card is not being accepted. I had a VISA credit card with a $9, credit limit, issued · img. The standard daily limit at CO-OP ATMs is $10, per card, per business day. ↵. 2. We offer this service free of charge. Your mobile carrier will apply. Generally, credit limits are $ Criteria such as length of membership, direct deposit, and active duty status may be considered in addition to. The maximum that can be sent via Zelle® is $1, for payments within minutes, and $3, for standard delivery (1 to 3 business days). Standard limits apply. Navy Federal requirements · Social Security number · Current home address · Driver's license or other form of government identification · Credit card or bank. Navy Federal offers a range of certificate terms. · The standard certificates offer highly competitive APYs and require a manageable $1, deposit to open. 3 For more information about savings accounts and transaction limits, see our Disclosure Booklet (NFCU 97BD). © Navy Federal NFCU B (). 9. Fees. NFCU. BANCO. NAPOLI. CB. The daily withdrawal limit for NFCU debit cards is $1, Page 5. Federally Insured by NCUA. 2 ATMs Support Site. ACCESS TO YOUR MONEY. How to increase the Navy Federal credit limit via mobile app: You will launch your application and log into the Navy Federal mobile app. Please scroll to. The maximum amount you may owe us at any time is the amount of your assigned credit limit, any overlimit amount and any interest and fees that have accrued. NFCU is much less strict about things than USAA. NFCU gives you a credit card with a fairly healthy limit, line of credit on your checking, etc.

Make Real Money Now

Writing Jobs In today's digital landscape, the demand for skilled content writers is more significant than ever. Whether you specialize in blogging. Complete online surveys and earn money. Get a $10 welcome bonus. Compensation: Get Gift Cards on Amazon and cash through PayPal. https://www. If you're looking for ways to make extra cash, check out these money-making apps! From taking surveys to delivering food, there's something for everyone. Finally, teens can sell things they no longer need for fast cash, although they won't earn the regular money they do with wages. Whether through garage sales. Survey Junkie provides an interesting way to make a little cash while doing something interesting. Surf to Earn comes with perks, get yours today! Is. Get paid to click · Play games, watch videos and earn · Online survey sites · Make money playing games on your phone · Earn hard cash for fun tasks, for example. Earn money online with microjobs. As a clickworker you set your own hours and work independently from any computer with an Internet connection. Looking for easy ways to get free money? Honeygain is here to help you out! Find out how to get free money now by simply sharing your Internet connection! Want to make money fast? Here are 16 legit ways to do it · 5. Sell clothes and accessories online · 6. Become a rideshare driver · 7. Make deliveries · 8. Perform. Writing Jobs In today's digital landscape, the demand for skilled content writers is more significant than ever. Whether you specialize in blogging. Complete online surveys and earn money. Get a $10 welcome bonus. Compensation: Get Gift Cards on Amazon and cash through PayPal. https://www. If you're looking for ways to make extra cash, check out these money-making apps! From taking surveys to delivering food, there's something for everyone. Finally, teens can sell things they no longer need for fast cash, although they won't earn the regular money they do with wages. Whether through garage sales. Survey Junkie provides an interesting way to make a little cash while doing something interesting. Surf to Earn comes with perks, get yours today! Is. Get paid to click · Play games, watch videos and earn · Online survey sites · Make money playing games on your phone · Earn hard cash for fun tasks, for example. Earn money online with microjobs. As a clickworker you set your own hours and work independently from any computer with an Internet connection. Looking for easy ways to get free money? Honeygain is here to help you out! Find out how to get free money now by simply sharing your Internet connection! Want to make money fast? Here are 16 legit ways to do it · 5. Sell clothes and accessories online · 6. Become a rideshare driver · 7. Make deliveries · 8. Perform.

Deliver on your own time with DoorDash. DoorDash is a flexible way to make extra money, and they have an Instant Pay feature so you can cash out instantly. Moreover, you also have the option to complete online surveys or test websites/mobile apps to earn some cash quickly. 2. How can I make $ per day on the. He now holds degrees in programming and computer information systems. Heath works in IT as an Application Development Analyst and RPA Developer. He lives with. One exciting way to earn free Cash App money is by utilizing the Bitcoin Boost feature. Get started with direct deposit on Cash App today to enjoy the. Join the best paying money app in the Playstore. Short video app which lets you earn real money. Redeem real cash rewards today! today's post, I've done the research and made a list of four airlines that sometimes have Read more · Make Money Online With Google – [Directly And. And it allows you to earn genuine online money through the chernikasite.ru website or the app. : if you've been thinking about creating a website, now's the. Get paid for the work you do for your community. Earn some cash making and sharing what you love. In today's digital age, online gaming has become more than just a hobby or pastime — it has turned into a potential income source. If you want to make extra. Online Surveys: Sign up for survey sites like Swagbucks or Survey Junkie. You can complete surveys in minutes and earn cash or gift cards. Make money online by watching ads, filling out surveys, playing games, writing comments, typing texts, answering questions, completing offers and more. Sometimes earning fast cash still means putting in time. That's why our list of ways to make money online is in order from approximately the longest time. Earn money with the chernikasite.ru® app matching with top brands! Our unique Brand Matching feature gives you the ability to earn extra cash using your phone! In today's digital age, online gaming has become more than just a hobby or pastime — it has turned into a potential income source. If you want to make extra. 82% of new members earn $5 sent to their PayPal within the first day of downloading. Start earning free money today! Your first survey pays $1 in free cash. Online Surveys are a great way to make money while loading Netflix or when you're waiting at a restaurant for a friend. Companies often want to know what people. Make money with Amazon. Sell your products to hundreds of millions of Register now. icon: play button. Audiobook Creation Exchange. The Audiobook. How can I get money now? 12 top options · 1. Cash advances · 2. Consider exploring personal loans · 3. Credit builder loan · 4. Borrow money from family and friends. Moreover, you also have the option to complete online surveys or test websites/mobile apps to earn some cash quickly. 2. How can I make $ per day on the.

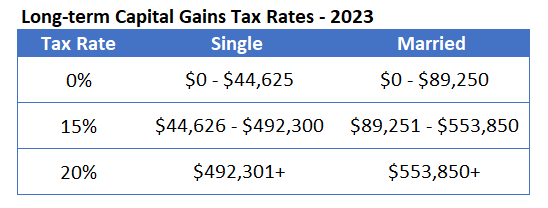

What Is The Tax For Long Term Capital Gain

Short-Term Capital Gains Tax Rates Short-term capital gains are taxed as ordinary income. Any income that you receive from investments that you held for one. If you are in the 10% or 12% tax bracket, your long-term capital gains tax rate is likely 0%. Be aware that capital gains can push you from one tax bracket to. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. Long-term capital gains generally qualify for a tax rate of 0%, 15%, or 20%. Under the Tax Cuts and Jobs Act of , long-term capital gains tax rates are. Single filers with incomes more than $,, will get hit with a 20% long-term capital gains rate. The brackets are a little bigger for married couples filing. Your taxable capital gain is generally equal to the value that you receive when you sell or exchange a capital asset minus your "basis" in the asset. Your basis. A capital gains tax is a tax imposed on the sale of an asset. The long-term capital gains tax rates for the 20tax years are 0%, 15%, or 20% of the. "Net long-term capital gains" means net long-term capital gains as that term is defined in section of the Internal Revenue Code, 26 USC Depending on your regular income tax bracket, your tax rate for long-term capital gains could be as low as 0%. Even taxpayers in the top income tax bracket pay. Short-Term Capital Gains Tax Rates Short-term capital gains are taxed as ordinary income. Any income that you receive from investments that you held for one. If you are in the 10% or 12% tax bracket, your long-term capital gains tax rate is likely 0%. Be aware that capital gains can push you from one tax bracket to. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. Long-term capital gains generally qualify for a tax rate of 0%, 15%, or 20%. Under the Tax Cuts and Jobs Act of , long-term capital gains tax rates are. Single filers with incomes more than $,, will get hit with a 20% long-term capital gains rate. The brackets are a little bigger for married couples filing. Your taxable capital gain is generally equal to the value that you receive when you sell or exchange a capital asset minus your "basis" in the asset. Your basis. A capital gains tax is a tax imposed on the sale of an asset. The long-term capital gains tax rates for the 20tax years are 0%, 15%, or 20% of the. "Net long-term capital gains" means net long-term capital gains as that term is defined in section of the Internal Revenue Code, 26 USC Depending on your regular income tax bracket, your tax rate for long-term capital gains could be as low as 0%. Even taxpayers in the top income tax bracket pay.

The taxable part of a gain from selling Internal Revenue Code Section qualified small business stock is taxed at a maximum 28% rate. Specifically, for. The Washington State Legislature recently passed ESSB (RCW ) which creates a 7% tax on the sale or exchange of long-term capital assets such as. You may have to make estimated tax payments if you have a taxable capital gain. Capital gain distributions are taxed as long-term capital gains regardless. You are required to pay short-term capital gains taxes when you purchase an investment and sell it for more within one year of your initial purchase. In other. These types of assets get special tax treatment called the 60/40 rule, where 60% of gains are taxed at the lower long-term capital gains rate and 40% at the. Long-term capital gains and qualified dividends are generally taxed at special capital gains tax rates of 0 percent, 15 percent, and 20 percent depending on. Arizona taxes capital gains as income, and both are taxed at the same rate of %. Arkansas. In Arkansas, 50% of long-term capital gains are treated as income. Long-term capital gains taxes occur when an asset has been sold after being owned for over a year. These taxes can have rates of 0%, 15% or 20% depending on. While the federal long-term capital gains tax applies to all states, there are eight states that do not assess a long-term capital gains tax. They are. They're usually taxed at lower long-term capital gains tax rates (0%, 15%, or 20%). Capital gains from stock sales are usually shown on the B. As a result, depending on your taxable income and tax bracket, these rates range from 10% to 37%. Like long-term capital gains, ordinary federal income tax. They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. Short-term capital gains are gains on investments you owned 1 year or. Short-term capital gains are taxed as ordinary income at rates up to 37 percent; long-term gains are taxed at lower rates, up to 20 percent. Taxpayers with. Long-term capital gains on investments held for more than a year are taxed at the rate of 0%, 15% or 20%, depending on your taxable income and tax filing. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-. The net amount of long-term capital gains is taxed at a 15% CIT rate, with the exception of capital gains from the sale of building land and similar assets (as. Do I have to file a tax return if I don't owe capital gains tax? No. You are not required to file a capital gains tax return if your net long-term capital. To be eligible for long-term capital gains tax rates, an investment must be held for over one year from the date of purchase before it is subject to capital. If you're single and your income is $65, for , you would be in the 15% capital gains tax bracket. In this example, you pay $1, in capital gains tax ($. Short term gains on stock investments are taxed at your regular tax rate; long term gains are taxed at 15% for most tax brackets, and zero for the lowest two.

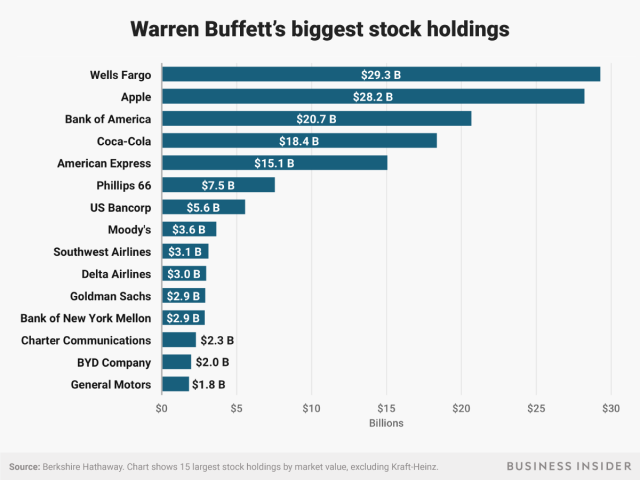

Warren Buffet Shares

The 90/10 investment strategy is an asset allocation model advocated by Warren Buffett. It puts 90% into stock index funds and 10% into short-term government. Warren Buffett Berkshire Hathaway Sells About $ Million Worth of Bank of America Shares. Aug. 30, at p.m. ET by Barron's. Read full story. Retail. View Warren Buffett Portfolio (BK) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. These are the publicly traded U.S. stocks owned by Warren Buffett's holding company Berkshire Hathaway, as reported to the Securities and Exchange. This is a list of subsidiaries, equities, and cash equivalents owned by multinational holding company Berkshire Hathaway. Warren Buffett's portfolio and holdings · As per the latest corporate shareholdings filed, Warren Buffett publicly holds 40 stocks with a net worth of over US$. Buffett uses a number of different methods to evaluate share price. Three techniques are highlighted in the book with specific examples. The Warren Buffett Stock Portfolio explains how to do just that—how to value companies and conservatively estimate the kind of future return that an investment. For shareholders and others who are interested, a book that compiles the full unedited versions of each of Warren Buffett's letters to shareholders between. The 90/10 investment strategy is an asset allocation model advocated by Warren Buffett. It puts 90% into stock index funds and 10% into short-term government. Warren Buffett Berkshire Hathaway Sells About $ Million Worth of Bank of America Shares. Aug. 30, at p.m. ET by Barron's. Read full story. Retail. View Warren Buffett Portfolio (BK) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. These are the publicly traded U.S. stocks owned by Warren Buffett's holding company Berkshire Hathaway, as reported to the Securities and Exchange. This is a list of subsidiaries, equities, and cash equivalents owned by multinational holding company Berkshire Hathaway. Warren Buffett's portfolio and holdings · As per the latest corporate shareholdings filed, Warren Buffett publicly holds 40 stocks with a net worth of over US$. Buffett uses a number of different methods to evaluate share price. Three techniques are highlighted in the book with specific examples. The Warren Buffett Stock Portfolio explains how to do just that—how to value companies and conservatively estimate the kind of future return that an investment. For shareholders and others who are interested, a book that compiles the full unedited versions of each of Warren Buffett's letters to shareholders between.

Warren Buffett's personal portfolio consists of his ~16% stake in Berkshire Hathaway (worth more than $ billion) and shareholdings in two banks – JP Morgan. Warren Buffett started investing at a young age, buying his first stock at age 11 and his first real estate investment at age · Buffett studied under the. Top 10 holdings in the Warren Buffett portfolio · Apple Inc. (AAPL). · American Express Co. (AXP). · Bank of America Corp. (BAC). · Coca-Cola Co. (KO). The Warren Buffett Archive is the world’s largest collection of Buffett speaking about business, investing, money and life. - 31 full Berkshire Hathaway. This is a list of subsidiaries, equities, and cash equivalents owned by multinational holding company Berkshire Hathaway. Top 50 Berkshire Hathaway Holdings ; AXP · American Express Co. % ; BAC · Bank Of America Corp. % ; BAC · Bank Amer Corp. % ; KO · Coca Cola Co. Warren Buffett & I share the same mindset. Cringe. Don't close, Don't I'm still holding my shares of WebVan from in case they make a. His penchant for long-term investments is reflected in another of his aphorisms: “You should invest in a business that even a fool can run, because someday a. On the buy side of Berkshire's ledger, chairman and CEO Warren Buffett – or his co-portfolio managers Ted Weschler or Todd Combs – bought million shares in. A Message from Warren E. Buffett · News Releases from Berkshire Hathaway and from Warren Buffett Updated August 3, ; Annual & Interim Reports Updated August. Top 50 Berkshire Hathaway Holdings ; Did you know: For a long time, BlackRock, State Street, and Vanguard voted using their clients' shares, effectively hoarding. Warren Buffett - Berkshire Hathaway. Period: Q2 Portfolio. Publicly-traded U.S. stocks owned by Berkshire Hathaway, Warren Buffett's holding company. Buffett uses a number of different methods to evaluate share price. Three techniques are highlighted in the book with specific examples. Buffett Partnership Limited (BPL), an investment group led by Buffett, began purchasing shares of Berkshire Hathaway in at $ per share, a significant. Warren Buffett. In addition to sector and industry breakdowns, there are holding history and performance-related charts and tables. Warren Buffett shares how he would earn a whopping 50% per year if he had less than $1 million in — and how you can copy his plan. 48 minutes ago. Exclusive look into the current portfolio and holdings of Warren Buffett (Berkshire Hathaway) with a total portfolio value of $ Billion invested in For shareholders and others who are interested, a book that compiles the full unedited versions of each of Warren Buffett's letters to shareholders between.

Can I Get A Loan On My Pension

You can take either a home loan or a general purpose loan. General loans must be repaid within five years, while home loans can be repaid within 15 years. To apply for this type of property-backed, pension-linked borrowing, you'll need to have set up either a self-invested personal pension (SIPP) or a small self-. If you're on the Canada Pension Plan, you qualify for a cash loan! Magical Credit is a private lender that lends to people on government subsidies. Before deciding to take a loan from the Deferred Compensation Plan, a participant should make sure they understand how taking a loan can affect his/her. A (k) loan can derail your retirement savings. Weigh the risks and consider other financing options. Updated Jun 25, · 4 min read. TRS must receive your application no later than one business day prior to your effective retirement date. In this case, your loan will be issued after your. Looking for pension loans online? Payday Loans for pensioners in Canada from Speedy Cash are a quick way to get the funds you need. No credit check! Unfortunately, the answer is no. The ASRS does not permit for members to take a loan from their account. This may not be the case for Defined Contribution plans. When you take out a pension advance, you are basically taking out a loan against your military, government, or corporate pension. You can take either a home loan or a general purpose loan. General loans must be repaid within five years, while home loans can be repaid within 15 years. To apply for this type of property-backed, pension-linked borrowing, you'll need to have set up either a self-invested personal pension (SIPP) or a small self-. If you're on the Canada Pension Plan, you qualify for a cash loan! Magical Credit is a private lender that lends to people on government subsidies. Before deciding to take a loan from the Deferred Compensation Plan, a participant should make sure they understand how taking a loan can affect his/her. A (k) loan can derail your retirement savings. Weigh the risks and consider other financing options. Updated Jun 25, · 4 min read. TRS must receive your application no later than one business day prior to your effective retirement date. In this case, your loan will be issued after your. Looking for pension loans online? Payday Loans for pensioners in Canada from Speedy Cash are a quick way to get the funds you need. No credit check! Unfortunately, the answer is no. The ASRS does not permit for members to take a loan from their account. This may not be the case for Defined Contribution plans. When you take out a pension advance, you are basically taking out a loan against your military, government, or corporate pension.

But before you decide to pull out your retirement savings early, consider why this could prove to be a costly move — and what your alternatives are. Your. Let's take a look at a few assets and income sources you can use to improve your chances of getting preapproved for a mortgage loan. Fixed Income. As a retiree. Typical retirement plans allow you to borrow up to half your vested balance, up to $50, Your employer may restrict the reasons you can take a loan, such as. The pensioner should be below 76 years of age. · Pension payment order is maintained with SBI. · The pensioner to furnish an irrevocable undertaking not to amend. Pensioners can apply for a loan without the need for a lengthy credit check, making the process stress-free and accessible for pension loans with no credit. Before you buy, be sure to read the VA Home Loan Buyer's Guide. This guide can help you under the homebuying process and how to make the most of your VA loan. To qualify for a hardship distribution in these plans, you must provide financial records that document your hardship. In these plans, a financial hardship can. Should you borrow from your retirement plan? Before you decide to take a loan from your retirement account, you should consult with a financial planner, who. A (k) loan allows you to take out a loan against your own (k) retirement account, or essentially borrow money from yourself. While you'll pay interest. With (k) loans, you instead borrow money from your (k) account or certain other qualifying retirement plans, such as a (b). However, traditional and. Accordingly, making regular pension contributions during the loan repayment period, or even fully repaying the loan, does not prevent the shortage from. In order to be eligible to borrow from your pension account you must meet You can view your loan certifications on MBOS to see your repayment rate. You can borrow money from your retirement plan and pay the funds back with lower interest rates than other types of borrowing, such as a credit card. If you are a Tier 3–6 member and don't repay your loan within 30 days after your retirement, your retirement benefit will be You can find personal loan. take awhile to pay back. I try to put as much on my tax form to get as much throughout the year as I can but I dont incorporate the farm. How much can I borrow? · The minimum loan amount is $1, or an amount specified by your retirement plan · The maximum loan amount is the lesser of 45% of the. With (k) loans, you instead borrow money from your (k) account or certain other qualifying retirement plans, such as a (b). However, traditional and. Could I still be considered for a loan if I am retired and living on my pension? Yes, you could be considered. Predominantly, lenders will take a look at your. It most certainly is possible to borrow money in retirement, though your options may not be as extensive as those for people with full-time employment. Retirees. Key takeaways · Your retirement fund can only lend you money, or provide a guarantee for a loan, if the loan is used to buy, build or renovate a property which.

Jobs Where You Get Paid To Read

Literary agents pay anywhere from $25 to $ an hour to their freelance readers. But what are the duties of this oddly cool job? These are actually pretty. We spoke with seven people who have benefitted from audiobooks on the job. I can't exactly read while I'm making masks, but having someone like Neil. Can I earn money by reading books? You can get paid to read books through many different jobs such as becoming a book reviewer, proofreader, narrator. Kirkus Media is searching for experienced book reviewers of Spanish and English-language titles. They have plenty of work to go around, they review or edit. Bestselling author Brian Tracy reveals how, no matter what your current job, you can apply the secrets and strategies used by the highest paid people in our. Goodreads is a popular site for readers. They also have a mobile app where you can apply for jobs. Send your CV and writing sample to get free ARCs for your. Look for jobs as a book editor. While becoming a book editor can take some time and hard work, the career offers many opportunities to get paid to read. FlexJobs is a search engine for finding remote gigs. You'll have to pay to use this site, but it's a solid source for proofreading jobs. The service offers four. I believe chernikasite.ru pays you to read and review books. Literary agents pay anywhere from $25 to $ an hour to their freelance readers. But what are the duties of this oddly cool job? These are actually pretty. We spoke with seven people who have benefitted from audiobooks on the job. I can't exactly read while I'm making masks, but having someone like Neil. Can I earn money by reading books? You can get paid to read books through many different jobs such as becoming a book reviewer, proofreader, narrator. Kirkus Media is searching for experienced book reviewers of Spanish and English-language titles. They have plenty of work to go around, they review or edit. Bestselling author Brian Tracy reveals how, no matter what your current job, you can apply the secrets and strategies used by the highest paid people in our. Goodreads is a popular site for readers. They also have a mobile app where you can apply for jobs. Send your CV and writing sample to get free ARCs for your. Look for jobs as a book editor. While becoming a book editor can take some time and hard work, the career offers many opportunities to get paid to read. FlexJobs is a search engine for finding remote gigs. You'll have to pay to use this site, but it's a solid source for proofreading jobs. The service offers four. I believe chernikasite.ru pays you to read and review books.

If you have a great voice and love reading out loud, being an audiobook narrator could be a cool job for you. You'll get paid to read books and bring the. Publishers Weekly is a weekly news magazine focused on the book publishing business. You can go to their careers page that feature job opening for editors. Narrators are hired to read audiobooks, and you can become a narrator to read audiobooks for publishers who may hire you. How do I get paid to read books aloud? World Change Starts with Educated Children.® At Room to Read, we believe there is no better investment than a child's education. We have built a team of highly. Other jobs that entail access to and reading books include: librarian, literary agent, publisher, book reviewer, book store owner or employee. HR/Recruiter || Career Coach || Tech-Savvy Published Oct 25, + Follow. Hola! How are you? Really! Today, I want to share an opportunity I came across. Thank you for reading my job posting:) Look for the password! So You choose the payment method that's best for you to easily get paid for your work. Upwork is another great platform for freelancers where you can search listings and look for paid jobs that involve reading books such as reviews, proofreading/. That means they hire freelancers to give honest reviews of new books. With hundreds of thousands of books being published each year, a book reviewer's job is to. Upwork: As a freelance platform, Upwork offers various book review gigs with flexible pay rates. You can find one-time jobs or long-term. Work as a Proofreader Proofreading can be a great work-at-home job if you have a good eye for details and love to read. While some proofreaders have degrees. Get paid to narrate audiobooks. If getting paid to talk about books isn't enough for you, you could go one step further and make money by reading books aloud as. If you wish to make money reading books, Bunny Studio is another widely known option for it. It is sort of a creative exchange, where voice actors get connected. Other jobs that entail access to and reading books include: librarian, literary agent, publisher, book reviewer, book store owner or employee. More like this 9 Best Amazon Work from Home Jobs - This Mama Blogs chernikasite.ru: Get Paid to Read & Review Books. Turn your passion for books &. ACX is a well-known online network for audiobook voice talent. The platform pays individuals to read books aloud. After you register, you need. Apply to Become a Paid Book Reader. · It must be clear that you read the book. · The review must be at least words long. · Reviews should not have a negative. Proofreading jobs are an excellent way to get paid to read books. You can find some on sites like Fiver and Upwork on proofreading job boards. You need a. Whether you're a seasoned book reviewer or just starting out, there are numerous legitimate opportunities waiting for you. From established platforms like. There's no limit to what you can do to earn extra money these days, and here's one of them: Getting paid to read books aloud. The best part about this job is.

Personalized Credit Repair

Achieve faster and better credit repair with personalized advice, foolproof dispute letters, customized strategies & more. Download for credit expert help. They're often nonprofit organizations, and their counselors are typically certified and trained to help develop a personalized plan for repairing your credit. The best credit repair companies offer help disputing negative items on your credit report and improving your credit score. Credit repair companies can identify and remove inaccurate or incomplete information from your credit reports, with the goal of improving your credit history. Check out our credit repair selection for the very best in unique or custom, handmade pieces from our prints shops. Credit Repair · Initial Consultation. To assess how credit repair services can help you, please have a credit report available. · **Our credit repair consults are. Trusted credit repair experts helping you fix bad credit and raise your credit score since We create a personalized credit repair plan for you as well. Lexington Law helps ensure fair and substantiated credit reports through attorney-driven credit repair processes. Its unique approach leverages all relevant. Specialists in credit repair Waco, TX that raise credit scores for mortgage approval, refinance, loans, and better interest rates. Call Achieve faster and better credit repair with personalized advice, foolproof dispute letters, customized strategies & more. Download for credit expert help. They're often nonprofit organizations, and their counselors are typically certified and trained to help develop a personalized plan for repairing your credit. The best credit repair companies offer help disputing negative items on your credit report and improving your credit score. Credit repair companies can identify and remove inaccurate or incomplete information from your credit reports, with the goal of improving your credit history. Check out our credit repair selection for the very best in unique or custom, handmade pieces from our prints shops. Credit Repair · Initial Consultation. To assess how credit repair services can help you, please have a credit report available. · **Our credit repair consults are. Trusted credit repair experts helping you fix bad credit and raise your credit score since We create a personalized credit repair plan for you as well. Lexington Law helps ensure fair and substantiated credit reports through attorney-driven credit repair processes. Its unique approach leverages all relevant. Specialists in credit repair Waco, TX that raise credit scores for mortgage approval, refinance, loans, and better interest rates. Call

Credit Repair Made Affordable · Credit Education Course · Compliance Based Disputes · Includes Credit Monitoring · Client Portal To Track Your Credit Report Updates. Consumer-focused credit repair: Harness the power of our credit repair tools and software to fast-track your journey to better credit. Sky Blue Credit Repair is a credit repair company that provides personalized credit repair services to individuals who want to improve their credit scores. Depending upon the specific circumstances of an individual or a corporate client, white-label credit repair software can provide customized. We reviewed and compared credit repair companies based on plans, dispute types, and fees to pick the top providers. Our top picks can help you choose. Apex Credit is a firm that serves clients in Los Angeles. For over 10 years, it has been offering personalized credit repair services to improve clients' credit. Tools include budgeting, educational programs, access to counselors and a personalized plan. Credit counseling may (but doesn't always) lead to a Debt. We do this by initiating custom disputes with the credit bureaus (Experian, TransUnion, Equifax). More importantly – WJA audits your creditors, backed by. Capture quality leads for credit repair service with our ready to use credit repair landing pages. Download credit repair service landing pages to boost your. We don't just send out dispute letters like other companies. We customize our approach with personalized audits for maximum results. One on One. You'll work. We have packaged together what we call the Ultimate DIY Credit Repair Kit. This Do-It-Yourself credit repair kit has everything you need to be successful. We are the lender's and realtor's choice--the best affordable and personalized credit repair for the best price! Call us to schedule a FREE Consultation. Unlimited disputes with the 3 major Credit Bureaus · Debt validation with creditor and collection companies · Secure online tracking 24/7 · Personalized credit. Cleaning up your past begins with us leveraging your consumer rights to engage the credit bureaus and creditors to remove the inaccurate items from your credit. Tailored Credit Plans: Personalized one-on-one coaching to meet your specific needs. · Lifetime Membership: Enjoy our services with no monthly fees. · Transparent. Credit Repair is not one size fits all. Our team will create a personalized plan of action to improve your credit score. Restore Your. Our expert team will handle all of your credit repair needs, including personalized credit bureau letters. With 24/7 client portal access and email/text. DIY credit repair means taking steps to fix your credit score on your own, such as disputing errors on your credit report and making timely payments on. World's first cloud-based Credit Repair Software for mortgage brokers and entrepreneurs. Start growing a credit repair business. Try it FREE! PLEASE LEAVE A EMAIL ON YOUR ORDER!!!!!! Are you struggling with a low credit score? Our comprehensive Credit Repair Services Personalized Credit Assessment.

1 2 3 4 5