chernikasite.ru

Learn

Investing Percentages

:max_bytes(150000):strip_icc()/the-5-percent-rule-of-investment-allocation-2466542_FINAL-f143cd6bc6a64b22a80f75a610da985e.gif)

Invest 10% to 25% of the stock portion of your portfolio in international securities. The younger and more affluent you are, the higher the percentage. Shave 5%. Each of the eleven L Funds is a diversified mix of the five individual funds (G, F, C, S, and I). They were designed to let you invest your entire portfolio in. The models are strategies that help investors choose how much to invest in stocks or bonds based on their goals and risk tolerance. These fees are often identified as a percentage of the fund's assets—the fund's expense ratio. (identified in the fund's prospectus as the total annual fund. Costs of onshore and offshore wind energy fell by 56 percent and 48 percent respectively. It's time to stop burning our planet, and start investing in the. In , just over a third (35 percent) of the national population had investments in stocks, bonds, mutual funds, exchange-traded funds (ETFs), or other. Learn why diversification is so important to investing, and find out what it takes to make it work. For Accredited Investors: Percent is an investment platform exclusively for accredited investors. To explore our offerings, you must meet specific income or net. On the surface, it appears as a plain percentage, but it is the cold, hard number used to compare the attractiveness of various sorts of financial investments. Invest 10% to 25% of the stock portion of your portfolio in international securities. The younger and more affluent you are, the higher the percentage. Shave 5%. Each of the eleven L Funds is a diversified mix of the five individual funds (G, F, C, S, and I). They were designed to let you invest your entire portfolio in. The models are strategies that help investors choose how much to invest in stocks or bonds based on their goals and risk tolerance. These fees are often identified as a percentage of the fund's assets—the fund's expense ratio. (identified in the fund's prospectus as the total annual fund. Costs of onshore and offshore wind energy fell by 56 percent and 48 percent respectively. It's time to stop burning our planet, and start investing in the. In , just over a third (35 percent) of the national population had investments in stocks, bonds, mutual funds, exchange-traded funds (ETFs), or other. Learn why diversification is so important to investing, and find out what it takes to make it work. For Accredited Investors: Percent is an investment platform exclusively for accredited investors. To explore our offerings, you must meet specific income or net. On the surface, it appears as a plain percentage, but it is the cold, hard number used to compare the attractiveness of various sorts of financial investments.

In this article, we'll provide you with all the information you need to successfully understand how much percentage of your savings you should invest. Calculate your investment earnings. Are you on track to reach your investment goal? Find out using Bankrate's investment calculator below. If you think you could tolerate a portfolio with 80 percent stocks and 20 percent bonds, build a portfolio with 70 percent stocks and 30 percent bonds. If you. The ITC is a 30 percent tax credit for individuals installing solar systems on residential property (under Section 25D of the tax code). The Section Investors in their 20s, 30s and 40s all maintain about a 42% allocation of U.S. stocks and 8% allocation of international stocks in their financial portfolios. Calculate your investment earnings. Are you on track to reach your investment goal? Find out using Bankrate's investment calculator below. investing in any security, investing in a mutual fund involves certain risks The target percentages for each type of investment are stated in the prospectus. Whether you're considering getting started with investing or you're already a seasoned investor, an investment calculator can help you figure out how to. Dividend yield - Annual percentage of return earned by a mutual fund. The yield is determined by dividing the amount of the annual dividends per share by the. The equity investments are spread across 9, companies to capture global value creation and diversify risk as best possible. About 70 percent of the fund is. Lock in a Percentage of Your Income. Most financial planners advise saving 10% to 15% of annual income. A savings goal of $ a month amounts to 12% of your. How should you determine your retirement asset allocation? Discover how to choose the right mix of investments to help you reach your retirement goals. What Is Ramsey Solutions' Investing Philosophy? · Get out of debt and save up a fully funded emergency fund first. · Invest 15% of your income in tax-advantaged. Ally Bank Savings Account · Annual Percentage Yield (APY). % APY · Minimum balance. None · Monthly fee. None · Maximum transactions. Unlimited withdrawals or. A mix of stocks, bonds, and cash investments that will work together to generate a steady stream of retirement income and future growth. Your ideal savings rate depends on your specific, long-term reasons for saving. You should consider the investment objectives, risks, charges and expenses. But a generational shift may help to popularize the approach even more. More than 40 percent of Millennials say they have engaged in impact investing, compared. Over the past 30 years, the difference between the total return and price return of the S&P has been about two percentage points annually, on average. Find. (Change in value + Income) / Investment amount = Percent return. For example, suppose you invested $2, to buy shares of a stock at $20 a share. Over. This publication explains the basics of mutual fund investing, how mutual funds percentage that you've identified in advance. The advantage of this method.

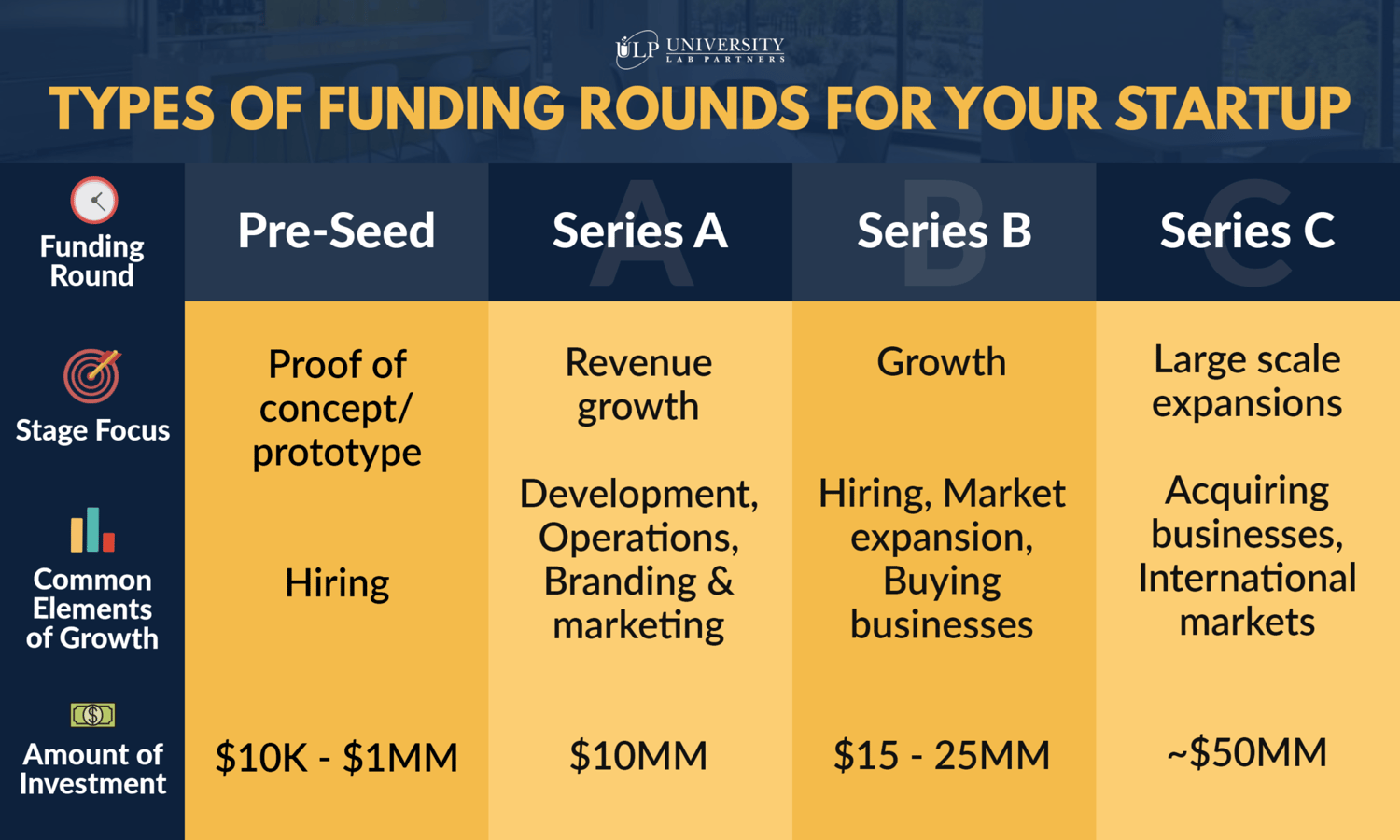

Series B And C Funding

Each stage represents a critical milestone in a startup's journey towards success, and knowing when and how to secure funding can make all the difference. These rounds provide startups with the much-needed funds to continue growing, while offering investors a share of equity in return. Series B funding is mostly used for scale — not development. Most venture firms expect a startup to be developed, revenue-drenched, and growth-ready. There's a. Series C Funding is a type of equity financing that typically occurs after Series A and B investment rounds. It often follows a company's initial public . Series A, B, and C funding rounds are separate fundraising events businesses use to raise capital. Each round is named for the series of stock being issued. Series A, B, and C funding rounds are different stages of raising capital for a company. Series A is typically the first round of funding and is used to. Series A B, C funding explained with updates. How funding rounds work, VC investors, averages, & valuations. Series A, B, C funding rounds refer to the process of growing a start-up business with the help of outside investments. Find out more in this Glossary! This stage of funding is all about scaling the business. Securing Series B funding will catalyze the next level of growth and tee a company up for later. Each stage represents a critical milestone in a startup's journey towards success, and knowing when and how to secure funding can make all the difference. These rounds provide startups with the much-needed funds to continue growing, while offering investors a share of equity in return. Series B funding is mostly used for scale — not development. Most venture firms expect a startup to be developed, revenue-drenched, and growth-ready. There's a. Series C Funding is a type of equity financing that typically occurs after Series A and B investment rounds. It often follows a company's initial public . Series A, B, and C funding rounds are separate fundraising events businesses use to raise capital. Each round is named for the series of stock being issued. Series A, B, and C funding rounds are different stages of raising capital for a company. Series A is typically the first round of funding and is used to. Series A B, C funding explained with updates. How funding rounds work, VC investors, averages, & valuations. Series A, B, C funding rounds refer to the process of growing a start-up business with the help of outside investments. Find out more in this Glossary! This stage of funding is all about scaling the business. Securing Series B funding will catalyze the next level of growth and tee a company up for later.

Similar to the previous stages of financing that include seed and series A financing, the series B round is a type of equity-based financing. In other words. Raising equity funding for your startup is a long, difficult, and often demoralizing process. However, if you're successful, you walk away with money that will. Series C funding is for companies that have established a strong market position and want to expand globally or enter new markets. This funding round can also. Imagine a graduated financing approach specifically designed for high-growth startups. That's the fundamental idea behind Series A, B, and C funding. These. A Series B round is usually between $7 million and $10 million. Companies can expect a valuation between $30 million and $60 million. Series B funding usually. Most Series A funding is expected to last 12 to 18 months. If a company still needs funds after this period to dominate its market, it can go through Series B. Series funding comprises of multiple rounds of fundraising. A startup presents their ideas to different investors and VC companies. Investors evaluate their. Series B funding comes after series A funding and is the second round of funding that a company receives. Series B funding is typically equal to. The purpose of naming the Series A, B, and C funding rounds is to rank payments to investors and ensure earlier investors receive preferential treatment. To. Series A funding is an all-important milestone that marks a startup's transition from concept validation to product development and market entry. Series B financing is the second round of funding for a business through investment, including private equity investors and venture capitalists. Series A, B and C funding rounds are merely stepping stones in the process of turning an ingenious idea into a revolutionary global company, ripe for an IPO. Series B funding round is the second round of funding for a company, and it is provided by investors such as private equity firms and venture capital firms. The. As such, major Series B investors are typically institutional investors such as multistage venture capital firms in addition to some growth stage-specific funds. Series A through E funding refers to successive rounds of venture capital financing for startups. Understanding how this funding works is critical for any. For other uses, see B Series and C Series. Venture capital financing rounds Increasingly, however, Series AA Preferred Stock investment rounds are. Series B fundraising can come from different types of investors including venture capital firms, corporate VCs, and family offices. One of the notable. Series C funding is a late stage of startup growth and is often the final round of equity funding before a company exits, either via IPO or another liquidity. The funding is typically used to scale the business by hiring additional staff, opening new offices, and expanding into new markets. These funds are used to. The financing pattern of venture capital typically follows through a series of funding rounds starting from pre-seed, seed, Series A, B, C, and sometimes D.

Stafford Loan Interest Rate Calculator

Origination Fee Rates. When you take out a federal student loan, you will be charged an origination fee by the U.S. Department of Education. This fee is a. First, consolidate your existing student loans and second use your payment savings to accelerate the payoff of your higher interest non-student debt. The. This loan calculator can be used with Federal education loans (Stafford, Perkins and PLUS) and most private student loans. The actual grant and loan amounts are determined once you apply through your provincial student aid office. Note. Canada Student Grants and Loans are not. Free calculator to evaluate student loans by estimating the interest cost, helping to understand the balance, and evaluating pay-off options. Canada student loans - 6 months after you leave school. Your monthly payment is automatically calculated. Your repayment schedule depends on: Your loan balance. Student Loan Calculator Based on your loans and income, you qualify for 7 repayment plans. Choose a plan below to see how it compares to all the others. Based on the amount borrowed, the minimum monthly payment for the Federal Stafford and Federal PLUS loans is $50; for the Federal Perkins Loan, it's $ Estimate the cost of your undergraduate student loan and find ways to save with our calculator. Change interest rates, terms and more. Try it out today! Origination Fee Rates. When you take out a federal student loan, you will be charged an origination fee by the U.S. Department of Education. This fee is a. First, consolidate your existing student loans and second use your payment savings to accelerate the payoff of your higher interest non-student debt. The. This loan calculator can be used with Federal education loans (Stafford, Perkins and PLUS) and most private student loans. The actual grant and loan amounts are determined once you apply through your provincial student aid office. Note. Canada Student Grants and Loans are not. Free calculator to evaluate student loans by estimating the interest cost, helping to understand the balance, and evaluating pay-off options. Canada student loans - 6 months after you leave school. Your monthly payment is automatically calculated. Your repayment schedule depends on: Your loan balance. Student Loan Calculator Based on your loans and income, you qualify for 7 repayment plans. Choose a plan below to see how it compares to all the others. Based on the amount borrowed, the minimum monthly payment for the Federal Stafford and Federal PLUS loans is $50; for the Federal Perkins Loan, it's $ Estimate the cost of your undergraduate student loan and find ways to save with our calculator. Change interest rates, terms and more. Try it out today!

To find your daily interest rate, divide your annual interest rate by Here's what that would look like for an interest rate of 6% / Next. For loans made up to award year, it is best to contact the loan servicer to confirm the interest rate. Student Loan Payment Calculator. Federal Loan. Loan Amount($) *: Annual Interest Rate (%) *: Months to Repay *: Required fields are marked with an asterisk (*). Footer. Federal Student Loan Management. Are you thinking about financing a college degree? A student loan calculator can help you estimate your monthly payments. Learn more at Citizens. Use our student loan calculator to help you estimate your payments and interest. Create a repayment plan to ensure you repay your student loans on time. Loan Simulator helps you calculate your federal student loan payment and choose a repayment plan that meets your needs and goals. They are all hosted on the Canada Student Financial Assistance Program Website. The exact formulas for calculating student loans can vary a great deal from. Calculate your student loan payoff with our student loan calculator. Plan your repayment, estimate interest, and get personalized tips to pay off debt. Based on your loans and income, you qualify for 7 repayment plans. Choose a plan below to see how it compares to all the others. Estimate the cost of your undergraduate student loan and find ways to save with our calculator. Change interest rates, terms and more. Try it out today! Student Loan Calculator Based on your loans and income, you qualify for 7 repayment plans. Choose a plan below to see how it compares to all the others. The interest rate factor is used to calculate the amount of interest that accrues on your loan. You can find your interest rate factor by dividing your loan's. Payment plans are interest-free but usually require a small fee. Talk to your college financial aid office for further details. When you're ready to apply. Use our Student Loan Calculator to find out expected monthly student loan payments & calculate how much student loan interest you will pay over time. The Discover student loan repayment calculator will help you determine how additional monthly payments can reduce the amount of interest you pay during. Use this amortization schedule calculator to see your monthly loan payment, interest and principal on a monthly basis as well as the lifetime interest. Want to know how interest rates differ between government student loans and student lines of credit? Our student loan payment calculator shows you how to. Our Student Loan Calculator is a straightforward tool tailored for both federal and private loans. Easily estimate monthly repayments, total interest, and loan. Federal student loans have an origination fee; therefore, the amount you may receive as a disbursement may be slightly lower than the amount you accept. Loan. Use this student loan calculator to help you estimate how much you need to borrow in private student loans, and estimate your monthly loan payments.

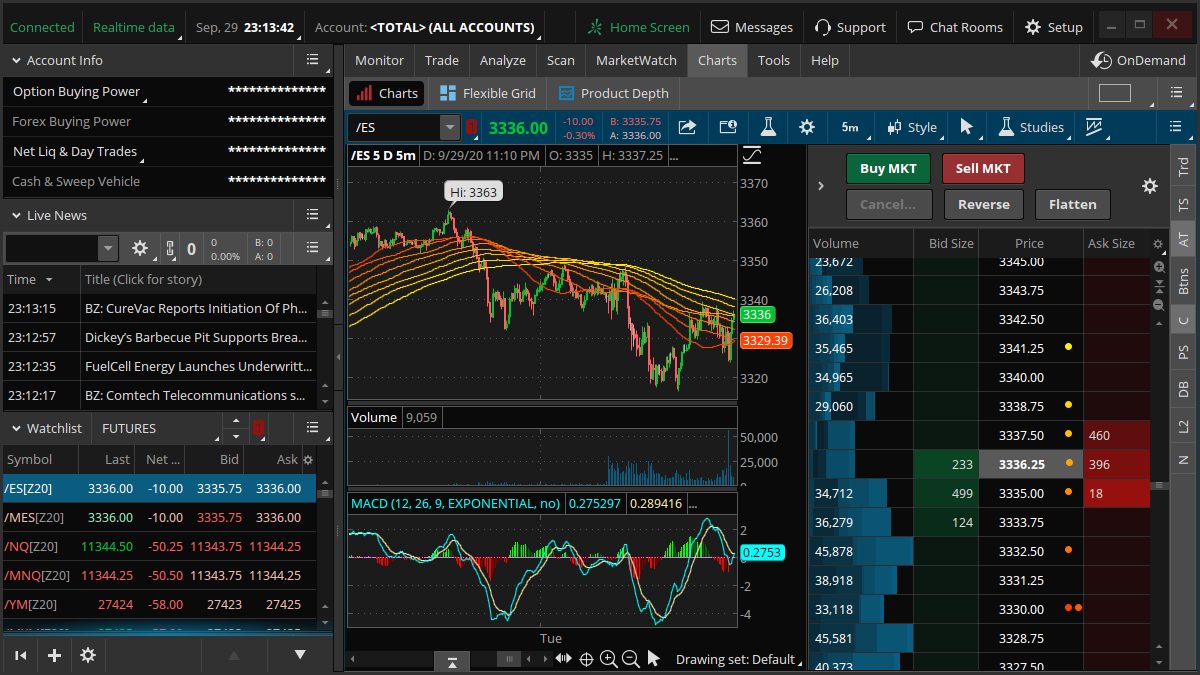

Free Thinkorswim Account

Level up your mobile trading experience with thinkorswim. Put the power of thinkorswim® right in your pocket with our trading app. Leverage automation to improve returns, find better trades, and transform into a superhuman trader. Learn more · Try It for Free. MacBook mockup. paperMoney® is the virtual trading experience that lets you practice trading on thinkorswim® using real-time market data—all without risking a dime. In addition, through its brokerage subsidiary, thinkorswim, Inc., Investools provides services to funded trading accounts for self-directed option traders and. Attend a Live Webinar with a Professional Trader. Learn how to best navigate Tradervue and ask trading questions in our FREE weekly webinar. Import your trades from ThinkorSwim. With just a few simple steps, you can have s of charts and statistics, trade charts and insights all automatically. The innovative ThinkOrSwim (TOS) graphics platform allows you to open a free paperMoney account which is a demo account with a min delayed data feed. Sharpen your trading skills risk-free. You'll have access to many of the same products, tools, and features you'd have during live trading within thinkorswim. Experience thinkorswim® desktop—a customizable trading software with elite tools that help you analyze, strategize, and trade like never before. Level up your mobile trading experience with thinkorswim. Put the power of thinkorswim® right in your pocket with our trading app. Leverage automation to improve returns, find better trades, and transform into a superhuman trader. Learn more · Try It for Free. MacBook mockup. paperMoney® is the virtual trading experience that lets you practice trading on thinkorswim® using real-time market data—all without risking a dime. In addition, through its brokerage subsidiary, thinkorswim, Inc., Investools provides services to funded trading accounts for self-directed option traders and. Attend a Live Webinar with a Professional Trader. Learn how to best navigate Tradervue and ask trading questions in our FREE weekly webinar. Import your trades from ThinkorSwim. With just a few simple steps, you can have s of charts and statistics, trade charts and insights all automatically. The innovative ThinkOrSwim (TOS) graphics platform allows you to open a free paperMoney account which is a demo account with a min delayed data feed. Sharpen your trading skills risk-free. You'll have access to many of the same products, tools, and features you'd have during live trading within thinkorswim. Experience thinkorswim® desktop—a customizable trading software with elite tools that help you analyze, strategize, and trade like never before.

That is just a quick overview of how to use a paper trade account OR real trade account right inside ThinkorSwim platform, part of TD Ameritrade. Feel free. Award-winning thinkorswim platforms. · More trading education than ever before. · Real support from real traders. · Commission-free trading experience. Paper Trading, NO, Yes ; Min Account Size, 0, 0 ; Accept International Accounts, NO, NO ; Market Data Costs, $5/mo for Gold, Free. Integrate thinkorswim. Take your trading to the next level by integrating thinkorswim with Chartlog. Create a free account and upload your trades. Get Started. Once you have opened an account with Charles Schwab, log in to thinkorswim Web to access essential trading tools and begin trading on our web-based platform. Sharpen your trading skills risk-free. paperMoney is the virtual trading experience that lets you practice trading on thinkorswim® using real-time market data. thinkorswim, NinjaTrader, and TradingView. Learn More Open and fund a new tastytrade account with $2, minimum to receive 6 free months of ShadowTrader Live. Put the power of thinkorswim® right in your pocket with our trading app. Manage your positions; find quotes, charts, and studies; get support;. What Is Thinkorswim? Thinkorswim is a free trading app available from TD Ameritrade. You can use it to buy stocks and options in the stock market. TD. ONLINE TRADING PLATFORMS. Overview · Explore our full array of trading tools including the suite of thinkorswim® platforms. Schwab Trading Powered by. Learn how to buy and sell stock on the thinkorswim® mobile app for iPhone. August 28, Trading Tools. Get a more streamlined thinkorswim experience. Open an account Log in now Commission-free trading experience. Trade listed equities online for $0. A one-stop trading app that packs many features of thinkorswim desktop into the palm of your hand. Stay connected to the market on the go with this secure. Open a free account. No credit card required. Fully test your integration/upload process. 2. Sync or upload your trades. Paper trading is available for free for 60 days for those without a funded TOS account, and is included for free with any funded account. Think Or Swim. How to Get a Free Thinkorswim Paper Trading Account with a $, balance · Step 1: Visit the Thinkorswim website and simply click "register here for. account. If someone claiming to represent or be associated with Simpler Trading solicits you for money or offers to manage your trading account, do not. Tax Free Savings Account (TFSA). Ideal for Mutual funds. ✓. ETFs. ✓. Options. Fixed income. ✓. Buy securities using leverage. Short selling. thinkorswim. Distraction-free reading. No ads. Organize your knowledge with lists and highlights. Tell your story. Find your audience. Get a Free PaperMoney Demo Account. Thinkorswim is a premiere, feature-rich, downloadable software platform. This is the one you've probably heard about. The.

What Does Home Warranty Insurance Cover

What Protection Does a Home Warranty Offer? A home warranty covers the cost of repairs and replacements of certain appliances and systems in your home caused. A home warranty is insurance that covers the built in appliances that come standard with a home. It can cover electric or gas stoves/ovens. Coverage includes financial protection before you take possession and protection against construction defects after you take possession. So What Does Homeowners Insurance Cover? Your homeowner's insurance policy will pay for any damaged or lost items that were caused by covered perils listed on. Home warranties provide additional coverages to consumers, such as coverage for HVAC, ductwork, plumbing and electrical and even utility lines and pools and. Your home warranty covers the things in your home that you and your family rely on most, like the refrigerator, dishwasher, heating and AC systems, and water. A typical home warranty will cover most major components of large home systems like your hot water heaters, HVAC, electrical, plumbing etc. It may also provide. What home insurance covers. Unlike a home warranty, home insurance covers damages to the house itself. It may also protect some of your personal possessions. A home warranty plan protects the appliances and systems in your home: major home appliances, electrical, plumbing, and HVAC systems. What Protection Does a Home Warranty Offer? A home warranty covers the cost of repairs and replacements of certain appliances and systems in your home caused. A home warranty is insurance that covers the built in appliances that come standard with a home. It can cover electric or gas stoves/ovens. Coverage includes financial protection before you take possession and protection against construction defects after you take possession. So What Does Homeowners Insurance Cover? Your homeowner's insurance policy will pay for any damaged or lost items that were caused by covered perils listed on. Home warranties provide additional coverages to consumers, such as coverage for HVAC, ductwork, plumbing and electrical and even utility lines and pools and. Your home warranty covers the things in your home that you and your family rely on most, like the refrigerator, dishwasher, heating and AC systems, and water. A typical home warranty will cover most major components of large home systems like your hot water heaters, HVAC, electrical, plumbing etc. It may also provide. What home insurance covers. Unlike a home warranty, home insurance covers damages to the house itself. It may also protect some of your personal possessions. A home warranty plan protects the appliances and systems in your home: major home appliances, electrical, plumbing, and HVAC systems.

A home warranty provides discounted repair and replacement services for covered household appliances and systems. In general, you don't need to provide. A home warranty is a renewable service contract that protects homeowners against the cost of unexpected repair or replacement of covered home systems and. A home warranty is a service contract that covers the cost of repairs and replacements for your home's systems and appliances when they break down over time. A builder's warranty is an essential part of any new construction. It covers the permanent parts of your home, like the foundation, plumbing, and electrical. It explains how new homes should perform and which defects – including design, materials or workmanship – may be covered under home warranty insurance in. A home warranty can cover service, repairs or replacement of your home's major appliances and mechanical systems. Homeowners insurance provides coverage for damage or loss to your home and personal belongings from fire, lightning, windstorms, hail, explosions, smoke. A homeowners' policy covers damage to your personal property and dwelling caused by major events, including natural disasters like wildfires. Home warranties do. What Home Warranty Coverage Includes Home warranties cover a wide variety of home systems and appliances in order to help you repair or replace these items. A home warranty is a renewable contract – typically lasting one year – that helps protect your household's most used items (like kitchen and laundry appliances. A home warranty covers service, repair, or replacement of major home appliances and systems. Homeowners insurance and home warranties are not the same. A home warranty is a service contract to help replace and repair home systems and appliances. Coverage often provides replacement services and discounts. On the other hand, homeowners insurance covers damage to the house and contents due to covered perils. 2 min to read. Explore Progressive's editorial standards. A home warranty is a service contract that covers household systems and appliances when they break down due to everyday use. What does homeowners insurance cover? While a home warranty may provide coverage for an appliance that's stopped working, what happens if someone steals your. Instead, warranties cover appliances and, with comprehensive coverage, plumbing, electrical, and HVAC systems. What Does Homeowners Insurance Cover? Homeowners. Home warranties are service contracts, not insurance policies. They provide homeowners with peace of mind. These plans pay for maintenance, replacements, and. A home warranty is a separate protection plan from your home insurance policy that provides coverage for your home's internal systems from typical wear and. Your home warranty coverage applies to items that will break down over time, thanks to their age and normal wear and tear. And what about homeowners' insurance? A home warranty is a protection plan that offers coverage for common home repairs. Learn everything you need to know about home warranties here!

Intuitive Surgical Stock Forecast

Intuitive Surgical Stock Forecast. Over the next 52 weeks, Intuitive Surgical has on average historically risen by % based on the past 24 years of stock. Intuitive Surgical Inc. analyst ratings, historical stock prices, earnings estimates & actuals. ISRG updated stock price target summary. Average Recommendation, Overweight. Average Target Price, Number Of Ratings, FY Report Date, 12/ Last Quarter's Earnings, Data Disclaimer: The Nasdaq Indices and the Major Indices are delayed at least 1 minute. Bid Price and Ask Price. The bid & ask refers to the price that an. HSBC Adjusts Price Target on Intuitive Surgical to $ From $, Maintains Buy Rating · BTIG Adjusts Price Target on Intuitive Surgical to $ From $ Intuitive Surgical (ISRG) stock price prediction is USD. The Intuitive Surgical stock forecast is USD for August View Intuitive Surgical, Inc. ISRG stock quote prices, financial information, real-time forecasts, and company news from CNN. Intuitive Surgical stock would need to gain 1,% to reach $10, According to our Intuitive Surgical stock forecast, the price of Intuitive Surgical. Intuitive Surgical (ISRG) has a Smart Score of 7 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund. Intuitive Surgical Stock Forecast. Over the next 52 weeks, Intuitive Surgical has on average historically risen by % based on the past 24 years of stock. Intuitive Surgical Inc. analyst ratings, historical stock prices, earnings estimates & actuals. ISRG updated stock price target summary. Average Recommendation, Overweight. Average Target Price, Number Of Ratings, FY Report Date, 12/ Last Quarter's Earnings, Data Disclaimer: The Nasdaq Indices and the Major Indices are delayed at least 1 minute. Bid Price and Ask Price. The bid & ask refers to the price that an. HSBC Adjusts Price Target on Intuitive Surgical to $ From $, Maintains Buy Rating · BTIG Adjusts Price Target on Intuitive Surgical to $ From $ Intuitive Surgical (ISRG) stock price prediction is USD. The Intuitive Surgical stock forecast is USD for August View Intuitive Surgical, Inc. ISRG stock quote prices, financial information, real-time forecasts, and company news from CNN. Intuitive Surgical stock would need to gain 1,% to reach $10, According to our Intuitive Surgical stock forecast, the price of Intuitive Surgical. Intuitive Surgical (ISRG) has a Smart Score of 7 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund.

This Robotics-Assisted Surgery Leader Just Posted Stellar Earnings. Is It A Buy? Intuitive Surgical is ready to continue its reign as the top dog in the. The 21 analysts with month price forecasts for Intuitive Surgical stock have an average target of , with a low estimate of and a high estimate of. According to analysts, ISRG price target is USD with a max estimate of USD and a min estimate of USD. Check if this forecast comes true in. Stock analysis for Intuitive Surgical Inc (ISRG:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company. comes to $ The forecasts range from a low of $ to a high of $ The average price target represents a decline of % from the last closing. Key Stock Data · P/E Ratio (TTM). (08/23/24) · EPS (TTM). $ · Market Cap. $ B · Shares Outstanding. M · Public Float. M · Yield. The all-time high Intuitive Surgical stock closing price was on August 22, The Intuitive Surgical week high stock price is , which is %. On average, Wall Street analysts predict that Intuitive Surgical's share price could reach $ by Aug 22, The average Intuitive Surgical stock price. With an average price target of $ between Citigroup, Redburn Atlantic, and Barclays, there's an implied % upside for Intuitive Surgical Inc from. Find the latest Intuitive Surgical Inc (ISRG) stock forecast, month price target, predictions and analyst recommendations. The average price target is $ with a high estimate of $ and a low estimate of $ Sign in to your SmartPortfolio to see more analyst recommendations. According to analytical forecasts, the price of ISRG may reach $ by the end of , and it is expected to be $1, by the end of Based on. Analyst Forecast. According to 21 analysts, the average rating for ISRG stock is "Buy." The month stock price forecast is $, which is a decrease of -. ISRG's current price target is $ Learn why top analysts are making this stock forecast for Intuitive Surgical at MarketBeat. The latest Intuitive Surgical stock prices, stock quotes, news, and ISRG history to help you invest and trade smarter. Get Intuitive Surgical Inc (ISRG:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Intuitive Surgical, Inc. (ISRG) stock forecast and price target · ISRGIntuitive Surgical, Inc. (%). At close: PM. The average one-year price target for Intuitive Surgical, Inc. is $ The forecasts range from a low of $ to a high of $ A stock's price. Is Intuitive Surgical stock A Buy? Intuitive Surgical holds several positive signals, but we still don't find these to be enough for a buy candidate. At the. Intuitive Surgical (ISRG) stock price prediction is USD. The Intuitive Surgical stock forecast is USD for August

Dorman Broker

NT is an affiliated company to NinjaTrader Brokerage (“NTB”), which is a NFA registered introducing broker (NFA #) providing brokerage services to. Dorman Trading, Dorman Tradin, Authorized E-Signature Dorman, Dorman Capital, Cmeg Broker Photo Id. Competitors, Advantage Futures, Altavest Worldwide Trading. Dorman Trading is one of the oldest, family-operated Futures Commission Merchants in the world. With decades of experience spanning three generations. Write Taaka Dorman's 1st recommendation. About Taaka Dorman. "Hi there! I'm Taaka Dorman, Broker in Charge and proud owner/operator of Kershaw Realty LLC. At. FMG Suite is not affiliated with the named representative, broker - dealer, state - or SEC - registered investment advisory firm. The opinions expressed and. Arielle Dorman joined Kidder Mathews in Arielle specializes in the sale of multifamily assets and development sites throughout the Puget Sound region. Dorman Trading, a stalwart in the world of Futures Commission Merchants (FCMs) since its inception in by Bernard Dorman, a seasoned grain trader at the. BrokerCheck is a trusted tool that shows you employment history, certifications, licenses, and any violations for brokers and investment advisors. Read honest reviews & opinions about Dorman Trading by verified clients. Comprehensive feedback to help you make informed decisions. NT is an affiliated company to NinjaTrader Brokerage (“NTB”), which is a NFA registered introducing broker (NFA #) providing brokerage services to. Dorman Trading, Dorman Tradin, Authorized E-Signature Dorman, Dorman Capital, Cmeg Broker Photo Id. Competitors, Advantage Futures, Altavest Worldwide Trading. Dorman Trading is one of the oldest, family-operated Futures Commission Merchants in the world. With decades of experience spanning three generations. Write Taaka Dorman's 1st recommendation. About Taaka Dorman. "Hi there! I'm Taaka Dorman, Broker in Charge and proud owner/operator of Kershaw Realty LLC. At. FMG Suite is not affiliated with the named representative, broker - dealer, state - or SEC - registered investment advisory firm. The opinions expressed and. Arielle Dorman joined Kidder Mathews in Arielle specializes in the sale of multifamily assets and development sites throughout the Puget Sound region. Dorman Trading, a stalwart in the world of Futures Commission Merchants (FCMs) since its inception in by Bernard Dorman, a seasoned grain trader at the. BrokerCheck is a trusted tool that shows you employment history, certifications, licenses, and any violations for brokers and investment advisors. Read honest reviews & opinions about Dorman Trading by verified clients. Comprehensive feedback to help you make informed decisions.

Broker Dealers, Clearing Firms & FCMs. Website. chernikasite.ru Similar Clients. Return to Portfolio · Gate39 Logo. 29 E. Madison Street Suite. Brokerage Services for Traders Contact Us Dorman Funding Instructions USD Wire Instructions USD Check Instructions - US ONLY. AMP Clearing. AGM Markets: Introducing Broker for Interactive Brokers. Support non-US residents only excluding Australia. Daniels Trading. Dorman Trading. If you account balance is under $5, and require a demo, email your broker at Stage 5 to set you up with a temporary day demo. Dorman Account FAQ. You may fund your account by transferring funds to Dorman Trading, LLC from an investment or brokerage account of another firm. A leader in industrial properties since , Thomas Dorman has consistently ranked among the Top 10 Industrial Brokers in the CBRE, Inc. Orange, California. Dorman International Wire. To request funds from your Dorman Trading Account, please complete the form below. IMPORTANT NOTE: Please include a VALID phone. Available methods of depositing money into an account: Bank Wire; Checks; Transfer between the accounts. The broker accepts USD, EUR, and AUD. Dorman Trading. Broker Inquiries, 1‐‐‐, option 1 (U.S.) 1‐‐‐, option 1 (non‐U.S.). Written requests: By Mail: Computershare P.O. Box Providence, RI. CATEGORY: BROKERAGES. General Information | Account Information | Features | Additional Comments. General Information TOP. Brokerage name: Dorman Trading. Dorman Trading is one of the world's oldest family-run futures brokers, established in by Bernard Dorman. iBroker is integrated with Dorman Trading, providing everyone using the CQG platform at Dorman with a fully synced experience between their CQG desktop. Open Account Online Trading Broker Assisted Managed Accounts Trading Tools IB Center About Us Site Map chernikasite.ru; All content © Dorman Trading. DANIEL DORMAN. NFA Member Approved. DORMAN TRADING LLC. Affiliated with Expand for history details. Date, Description. 09/30/, FLOOR BROKER WITHDRAWN. Dorman", but in getting David Dorman you also get the owner of the business, a licensed Broker, and a top notch, multi-award winning, board-certified. For over 50 years, Dorman Trading has provided futures traders and brokerage firms professional service and support. From a selection of almost 40 trading. Matthew Dorman is a yacht broker specialized in s in Miami Beach, Florida. David Dorman - Sr. Mortgage Advisor - Executive Mortgage Brokers,LLC, Edina, Minnesota. 96 likes. Executive Mortgage Brokers, LLC (NMLS# ) is a. Broker associate at Encore Sotheby's International Realty · i am a very goal oriented person with an appetite to always be the best i can be. i want to work. A brokerage firm, also called a broker-dealer, is in the business of buying and selling securities – stocks, bonds, mutual funds, and certain other investment.

Asset Allocation Strategies By Age

age and your goal of impending retirement moderate your aggressive investment strategy. If you're a conservative investor, but you're 22 and earning an. Generally, investors hold less of their savings in stocks as they near retirement age. Target-date funds are a way to shift your investment allocation by age. Investors in their 20s, 30s and 40s all maintain about a 42% allocation of U.S. stocks and 8% allocation of international stocks in their financial portfolios. Financial advisors used to recommend that a portfolio include 60% stocks and 40% bonds and other fixed-income securities, with a higher allocation to stocks. As a general rule, your target asset allocation can be determined by subtracting your age from either or The resulting number is the approximate. Younger investors who have long time horizons are often willing to bear more market risk in pursuit of higher expected returns. As workers age and their. A traditional way of determining how much you should allocate to stocks is to subtract your age from For example, if you're 25, you would have 75% of your. The fundamental idea behind asset allocation by age is that as you get older, your exposure to high-risk asset classes should decrease. Due to the high risk. The models are strategies that help investors choose how much to invest in stocks or bonds based on their goals and risk tolerance. age and your goal of impending retirement moderate your aggressive investment strategy. If you're a conservative investor, but you're 22 and earning an. Generally, investors hold less of their savings in stocks as they near retirement age. Target-date funds are a way to shift your investment allocation by age. Investors in their 20s, 30s and 40s all maintain about a 42% allocation of U.S. stocks and 8% allocation of international stocks in their financial portfolios. Financial advisors used to recommend that a portfolio include 60% stocks and 40% bonds and other fixed-income securities, with a higher allocation to stocks. As a general rule, your target asset allocation can be determined by subtracting your age from either or The resulting number is the approximate. Younger investors who have long time horizons are often willing to bear more market risk in pursuit of higher expected returns. As workers age and their. A traditional way of determining how much you should allocate to stocks is to subtract your age from For example, if you're 25, you would have 75% of your. The fundamental idea behind asset allocation by age is that as you get older, your exposure to high-risk asset classes should decrease. Due to the high risk. The models are strategies that help investors choose how much to invest in stocks or bonds based on their goals and risk tolerance.

Your current age. This is by far the most important aspect of asset allocation. For most people the majority of their portfolio is for their retirement. The. Asset allocation is a strategy of dividing an investor's portfolio among different asset classes based on three key factors – investment objectives, risk. Younger investors who have long time horizons are often willing to bear more market risk in pursuit of higher expected returns. As workers age and their. Should plans offer different funds based on age The first type of error isn't likely to cause too much damage, because even a naive allocation strategy will. The classic recommendation for asset allocation is to subtract your age from to find out how much you should allocate towards stocks. The basic premise is. Portfolio Strategies · View your advisor. Find an advisor. Find an advisor your With a % inflation rate, the purchasing power of $1 million at age 60 is. The basic principle behind age-based asset allocation is that your exposure to investment risk needs to reduce with age. Asset allocation means deciding what portion of your portfolio to invest in different asset classes These strategies are all about variety. If done well. Your age and net worth. Downside of Asset Allocation. A diversified portfolio MAY generate a lower rate of return when compared to a single “hot” asset. Consider retirement asset allocation models by age ; 50s · % · % ; 60s · % · % ; 70s & Older · % · %. [A]s we age, we usually have (1) more wealth to protect, (2) less time to recoup severe losses, (3) greater need for income, and (4) perhaps an. Therefore, most financial advisors advise investors to make the stock investment decision based on a deduction of their age from a base value of a The. The Specialty/Alternative class consists of funds with less traditional investment strategies, including REITs and commodities, that aim to provide. asset allocation research within portfolio strategy in Goldman Sachs Research. “The best way to put it is there is less downside risk, but also very little. During your early years of retirement (age ), consider a moderate Diversification, asset allocation and rebalancing strategies do not ensure a. As the beneficiary ages, assets are periodically transferred to the next age based portfolio within the risk track, which invests a greater portion in more. For example, most people investing for retirement hold less stock and more bonds and cash equivalents as they get closer to retirement age. You may also need to. John Bogle said that "as we age, we usually have (1) more wealth to protect, (2) less time to recoup severe losses, (3) greater need for income, and (4) perhaps. The first step is the asset allocation decision, which can refer to both the process and the result of determining long-term (strategic) exposures to the.

What Annuities Are Best

A life annuity can be a great source of retirement income. Try our annuity calculator to find out how much you can get with a life annuity. New York Life Guaranteed Lifetime Income Annuity II ; 65, %, % ; 70, %, % ; 75, %, % ; 85, %, %. An annuity is an insurance contract where you, the purchaser, pay an insurance company to invest your money, allowing it to grow tax-deferred. best for you. What is an Annuity? An annuity is a contract in which an insurance company makes a series of income payments at regular intervals in return. Annuities can be purchased that offer payments over your life (and even a loved one's life). The longer you live, the greater the benefit your annuity may hold. An annuity is a contract with an insurance company to turn your lump sum or periodic premium payments into a reliable income stream for retirement. Annuity rates in the UK have risen by 14% in two years. Is now the best time to buy an annuity? We look at what this means for your retirement income. Annuities provide a steady income stream, typically for retirees, helping manage the risk of outliving savings. They come in various forms, including fixed. Annuities can help you step into retirement with the certainty of a For the best experience, please update to a modern browser like Chrome, Edge. A life annuity can be a great source of retirement income. Try our annuity calculator to find out how much you can get with a life annuity. New York Life Guaranteed Lifetime Income Annuity II ; 65, %, % ; 70, %, % ; 75, %, % ; 85, %, %. An annuity is an insurance contract where you, the purchaser, pay an insurance company to invest your money, allowing it to grow tax-deferred. best for you. What is an Annuity? An annuity is a contract in which an insurance company makes a series of income payments at regular intervals in return. Annuities can be purchased that offer payments over your life (and even a loved one's life). The longer you live, the greater the benefit your annuity may hold. An annuity is a contract with an insurance company to turn your lump sum or periodic premium payments into a reliable income stream for retirement. Annuity rates in the UK have risen by 14% in two years. Is now the best time to buy an annuity? We look at what this means for your retirement income. Annuities provide a steady income stream, typically for retirees, helping manage the risk of outliving savings. They come in various forms, including fixed. Annuities can help you step into retirement with the certainty of a For the best experience, please update to a modern browser like Chrome, Edge.

Complete profiles of today's most successful annuities Experttips on how to maximize your returns Variable annuities now outpace mutual funds as the. Which Annuity is Right for Me? · Safety: Backed by highly rated state-regulated insurers · Tax Deferral: Tax-deferred growth · Higher Return: Better interest rates. About Allianz Life. Allianz Life Insurance Company of North America (Allianz Life®) has been keeping its promises since As a leading provider of annuities. Compare The Best Three-Year Fixed Annuities ; Ohio State Life, %, $10K ; National Security Life, %, $25K ; Revol One, %, $25K ; EquiTrust Life Life. chernikasite.ru provides the best life annuity rates in Canada. We quote from all the top leading insurance companies in Canada. Top Income Investments in What investors should know about income-producing assets for stable returns and lower portfolio risk. Kate Stalter and. Variable annuities. Stay invested in the market with the potential to grow your retirement savings and receive guaranteed income. · Fixed annuities. Lock in a. We understand your need to research annuity providers, so we've put together some great tools to help you compare annuity companies before your purchase. The best-indexed annuities will offer the highest income and upside potential while providing high protection for your savings. Annuities can be complex, but their income guarantees can potentially complement many different retirement income strategies. And even though payout rates are. Best Multi-Year Guaranteed Fixed Annuity Rates for September ; Certainty Select 10 · EquiTrust Life Insurance Company, B++, 10, % ; Diamond Head MYGA 9. Understanding the features and benefits offered by annuities · Flexibility · Rate lock-ins · Payment dates · Security · Spousal protection. Annuity FYI's Top Picks represent what we feel are the best annuities among the thousands of products in the marketplace today. Best 3 Year Guaranteed Rates ; Company, Product, 3 yr, MVA Product? Buy Direct? ; Canvas Annuity, Future Fund, %, No, Yes ; Security Sentinel, Personal Choice. Fixed Index Annuities (FIA) ; Allianz (AM Best A+)Core Income 7 ; Great American (AM Best A+)American Legend 7 ; Symetra (AM Best A)Edge Pro 7 ; Midland National . Whether or not an annuity is a good investment will depend on your individual circumstances and financial objectives in retirement. Whereas annuities pride. ICICI Pru Guaranteed Pension Plan Flexi is a non-linked, non-participating deferred annuity plan that provides you with an assured income and the best annuity. Best Multi-Year Guaranteed Fixed Annuity Rates for September ; Safe Haven 6 · Atlantic Coast Life Insurance Company, B++, 6, % ; AnnuityAdvantage®. AM Best is the leading provider of ratings, news, analysis, and financial information for the life/annuity insurance industry. Best's Credit Ratings are.

How Much To Put In Skylight

The cost varies depending on the type of skylight, the number you plan to install and your ceiling type. The cost of installing a skylight depends on a number of things: Location and size of the skylight, cost of materials, and professional labor being three of the. The average price range is typically somewhere between $ and $2,, with the national average being approximately $1, A professional can provide an. learn about skylight and roof installation. SKYLIGHT INSTALLATION COST. Depending on the style of roof and skylight, skylight installation costs vary. Ranch. learn about skylight and roof installation. SKYLIGHT INSTALLATION COST. Depending on the style of roof and skylight, skylight installation costs vary. Ranch. How Much Does a Skylight Cost? · The price for a tubular skylight (without installation) starts around $$ for a small, basic model to $$ or more. Prices for skylights vary with many factors, including ceiling style. Here are three cost breakdown examples of different kitchen skylight installations. Residential skylights cost between $ and $3, to install, while commercial alternatives range between $1, and $4, Commercial roof. Can I DIY a skylight installation? The labor costs to install a skylight typically run from $ to $, depending on the type of skylight, where it will be in. The cost varies depending on the type of skylight, the number you plan to install and your ceiling type. The cost of installing a skylight depends on a number of things: Location and size of the skylight, cost of materials, and professional labor being three of the. The average price range is typically somewhere between $ and $2,, with the national average being approximately $1, A professional can provide an. learn about skylight and roof installation. SKYLIGHT INSTALLATION COST. Depending on the style of roof and skylight, skylight installation costs vary. Ranch. learn about skylight and roof installation. SKYLIGHT INSTALLATION COST. Depending on the style of roof and skylight, skylight installation costs vary. Ranch. How Much Does a Skylight Cost? · The price for a tubular skylight (without installation) starts around $$ for a small, basic model to $$ or more. Prices for skylights vary with many factors, including ceiling style. Here are three cost breakdown examples of different kitchen skylight installations. Residential skylights cost between $ and $3, to install, while commercial alternatives range between $1, and $4, Commercial roof. Can I DIY a skylight installation? The labor costs to install a skylight typically run from $ to $, depending on the type of skylight, where it will be in.

Prices for small, basic roof lights start at around $, not including installation costs. As the size increases so does the cost, and extra features such as. Prices for small, basic roof lights start at around $, not including installation costs. As the size increases so does the cost, and extra features such as. The pricing varies based on the type of opening mechanism. This includes Manual Opening, Electric and Solar operated devices. The average price for a basic. Installing a skylight window typically takes 6 to 12 hours when a team of two people is working on it. If you're adding a balcony, the process can take 1 to 2. It's between $$, all in, on materials and labor, depending on if it's a sealed skylight vs. being a vented skylight. The average skylight window costs about $ or higher with most prices varying within $ to $ per window. Other cost factors include the choice of pane. The average skylight window costs about $ or higher with most prices varying within $ to $ per window. Other cost factors include the choice of pane. When replacing an existing skylight, the costs may be lower because the opening and support structures are already in place. The average skylight replacement. Ready to Install Skylights? The costs of installing a skylight will range from $ to $3, but remember that this will still change. Recall determining. Prices will depend upon the model of skylight and the type of roof it's being installed into but range from $ to $ per skylight. However, installation adds another $ to $3, to the project cost -- good reason to carefully evaluate whether a skylight is right for you. Until recently. Residential skylights cost between $ and $3, to install, while commercial alternatives range between $1, and $4, Commercial roof windows tend to be. Listed below are price ranges for installation of a new, single skylight, including labor for interior and exterior finish work and for replacing an old. Prices for Velux skylights range from $ for a fixed comfort double-glazed skylight right through to a massive mm x mm solar-powered skylight for a. In general, your contractor will be able to install your skylight in as little as a half day or up to three days. The timeline will depend on the complexity of. You need between $ and $ to install a fixed skylight onto your roof. And putting up a tubular skylight will cost you between $ and $ 1, The pricing varies based on the type of opening mechanism. This includes Manual Opening, Electric and Solar operated devices. The average price for a basic. The cost of installing a skylight depends on a number of things: Location and size of the skylight, cost of materials, and professional labor being three of the. In general, your contractor will be able to install your skylight in as little as a half day or up to three days. The timeline will depend on the complexity of. It cost an average of $1, to install a skylight. Typical prices however range between $ and $2, The fixed skylight is the most popular option and.

1 2 3 4 5 6